Thrift Savings Plan Fers

Beginning this year the Thrift Savings Plan did away with separate catch-up contributions so for someone who is 50 and can afford to contribute the full 26000 the numbers in the preceding.

Thrift savings plan fers. Depending on which retirement system you belong. Retirement Benefits under FERS. Members of the uniformed services also participate in it.

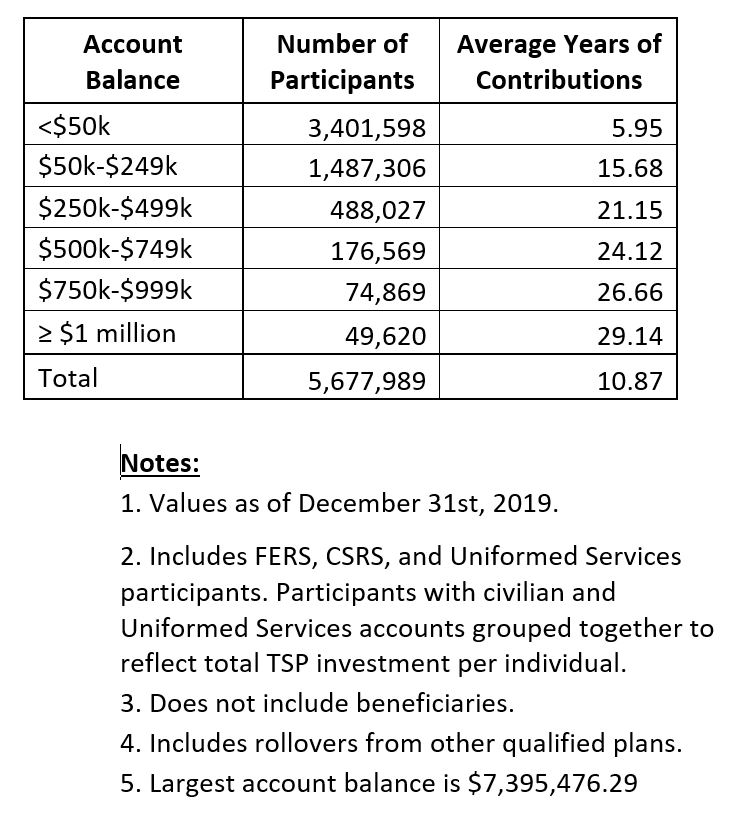

FERS or uniformed services participants. Established by Congress in the Federal Employees Retirement System Act of 1986 the TSP is similar to what is offered to employees of private sector corporations in form of 401k plans. The Thrift Savings Plan TSP is a defined-contribution plan for Federal civil service employees and retirees.

It was established by federal law in 1986. Participants have their choice of investment funds with the ability to change contribution allocations daily as well as making inter-fund transfers. The Thrift Savings Plan TSP is a tax-deferred retirement savings and investment plan for federal employees and members of the uniformed services including the Ready Reserve.

A federal employee covered by the Federal Employees Retirement System FERS. The minimum amount you can take is 1000 but there is no limit to how many you can take in your lifetime. The TSP is a payroll withholding based plan.

If you guard all your retirement savings completely against volatility the 5 rate of return that we show as an example may be unrealistically high. The rate of return you assume for your account while you are receiving TSP monthly payments will depend on how you plan to have your account balance invested in retirement. Your spouse must consent to your TSP loan by signing the Loan Agreement that you print from My Account.

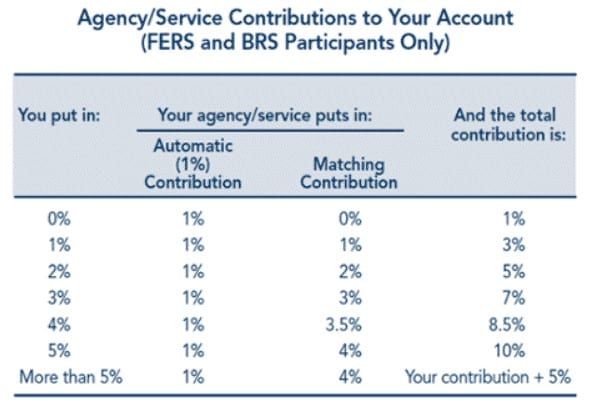

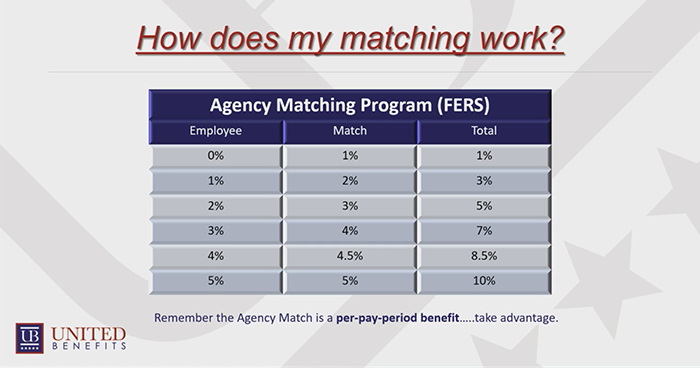

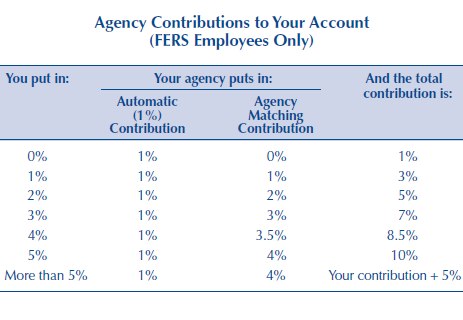

Eligibility Your retirement system determines whether you can participate in the TSP. Each pay period your agency deposits into your account amount equal to 1 of the basic pay you earn for the pay period. These contributions are tax-deferred.

My Account Plan Participation Investment Funds Planning and Tools Life Events and. For FERS employees it is essential that you make contributions to the TSP if you hope to enjoy a comfortable retirement. Youre eligible to participate if youre in the following groups.

The Thrift Savings Plan TSP is a valuable way to save for your retirement. The Thrift Savings Plan TSP is a retirement savings plan similar to 401k plans offered to private sector employees. Combining that with FERS the OPM Ballpark Estimate says I will have enough for 30 years of retirement.

A Basic Benefit Plan Social Security and the Thrift Savings Plan TSP. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their. For CSRS employees the TSP offers a convenient and powerful mechanism for building up your savings.

It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees under 401k plans. Processing times limit you to one withdrawal every 30 days. Exceptions to the spousal rule may be approved under very limited circumstances.

Retirement benefits under FERS are structured as annuities. Here are the basics of the TSP matching program. For FERS employees the matching inside the Thrift Savings Plan is the greatest advantage you have when building your balance.

Through the Thrift Savings Plan you can put some of your pay toward retirement savings. We must notify your spouse when you apply for a loan. If you need a portion of your TSP savings right away but want to leave the rest to continue growing consider withdrawing just a portion of your account.

The agency will match a portion of your TSP contributions with the percentage varying based on how much you are contributing. Forgot your account number or user ID. Two of the three parts of FERS Social Security and the TSP can go with you to your next job if you leave the Federal Government before retirement.

You can also make your own contributions to your TSP account and your agency will also make a matching contribution. FERS is a retirement plan that provides benefits from three different sources. Offers loans withdrawals freedom to.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. 24 years remaining until retirement at age 62. Mandatory distribution at 70 12 years of age.

GS-13-06 126000 in 2022 TSP balance 200k. Calculators show that I am on track to have 15-2m in TSP by retirement. Immediate employee contributions before-tax savings and tax deferred earnings.

FERS was modeled after the most progressive private-sector retirement plans with a defined government benefit Social Security and a super 401k like plan the TSP into which the employer would match up to 5 of an employees contributions to the Thrift Savings Plan.

/BRSChecklist-3daf483da74c41bcbc54f15a714e3dc3.jpg)