Payment Plan With Irs

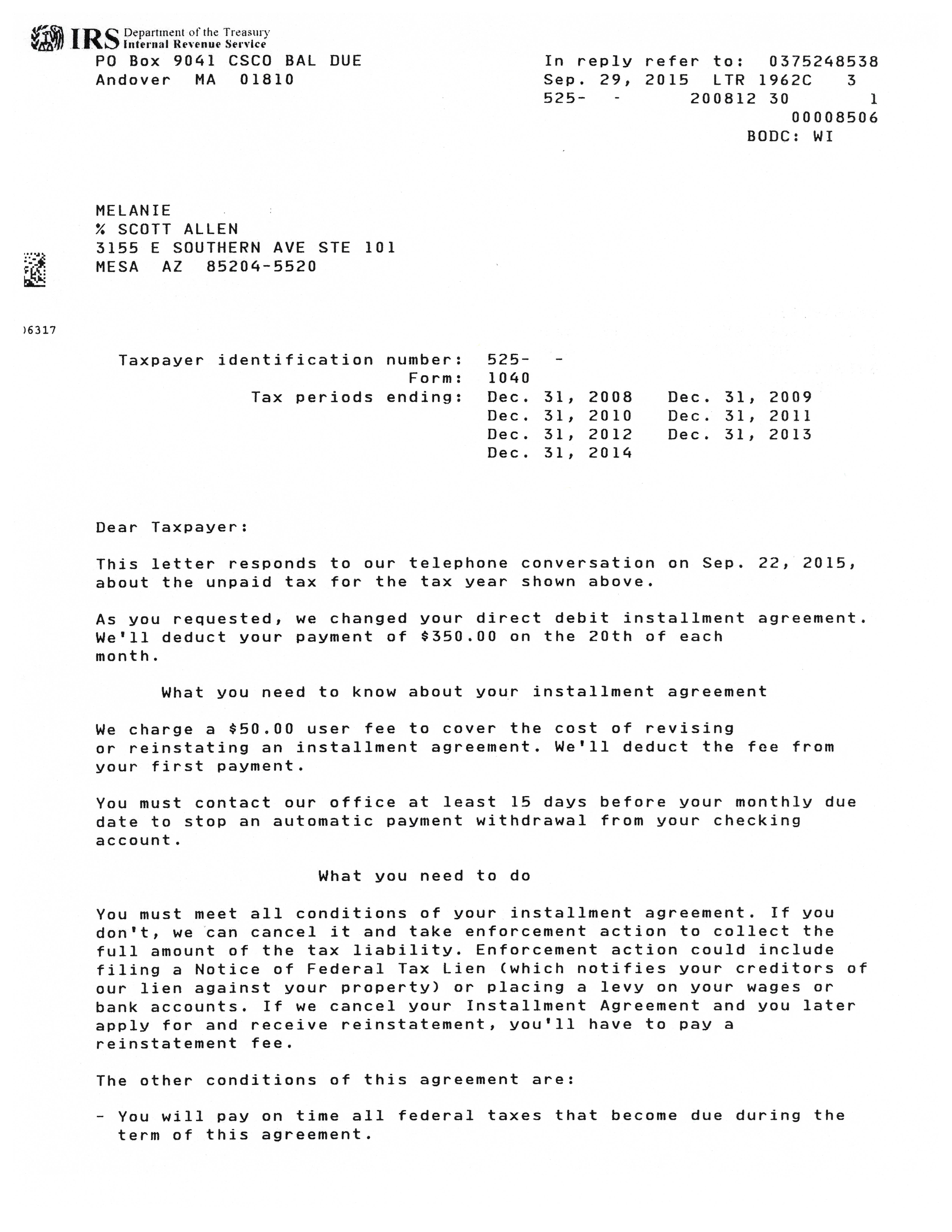

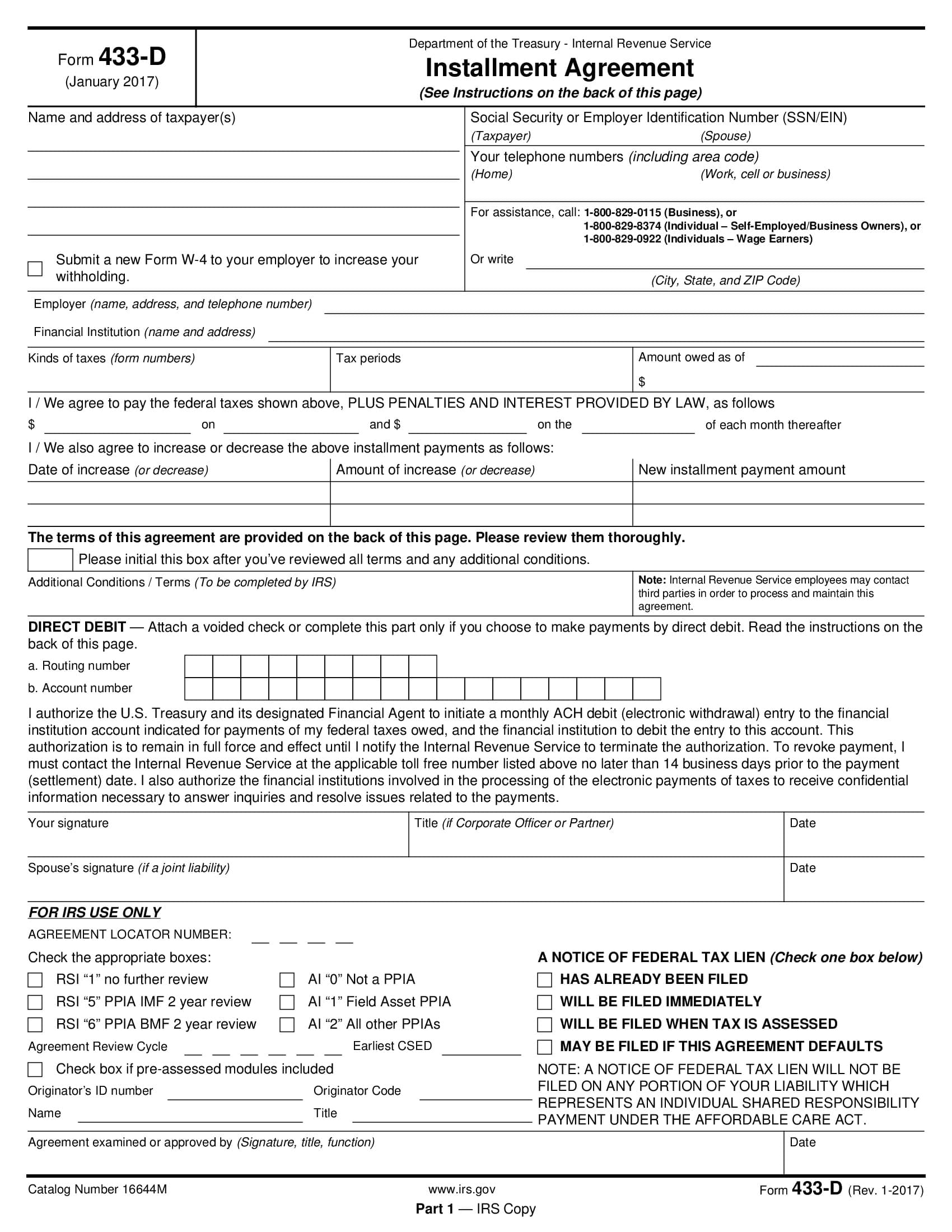

Long-Term Payment Plan Installment Agreement pay monthly Pay monthly through automatic withdrawals.

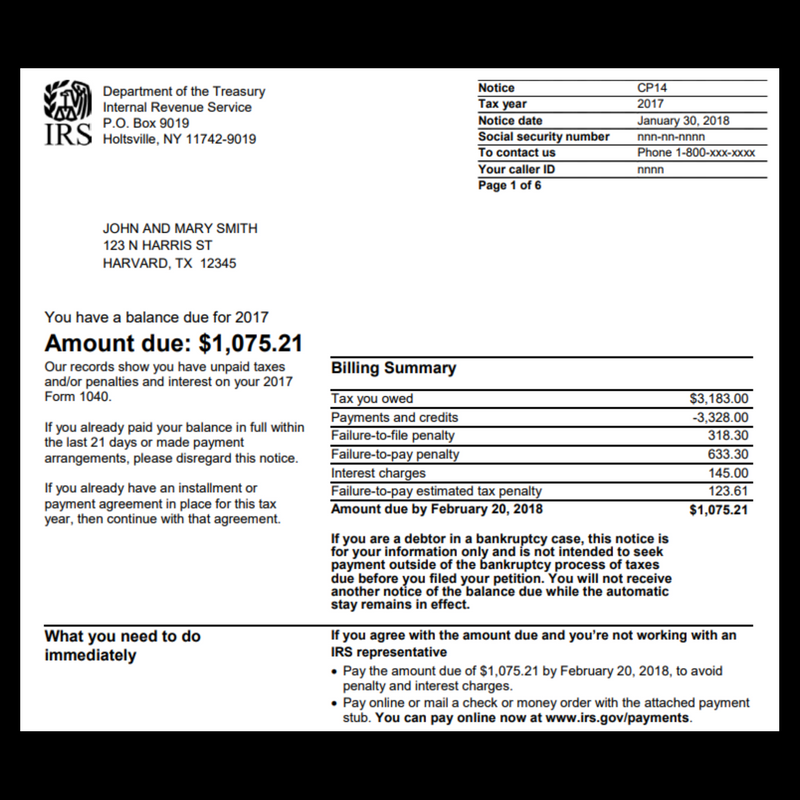

Payment plan with irs. Go to Your Account. These debts are to be repaid in the provided timeframe that got extended. Targeting means that you pay off your tax debt to meet the requirements of a particular type of installment agreement.

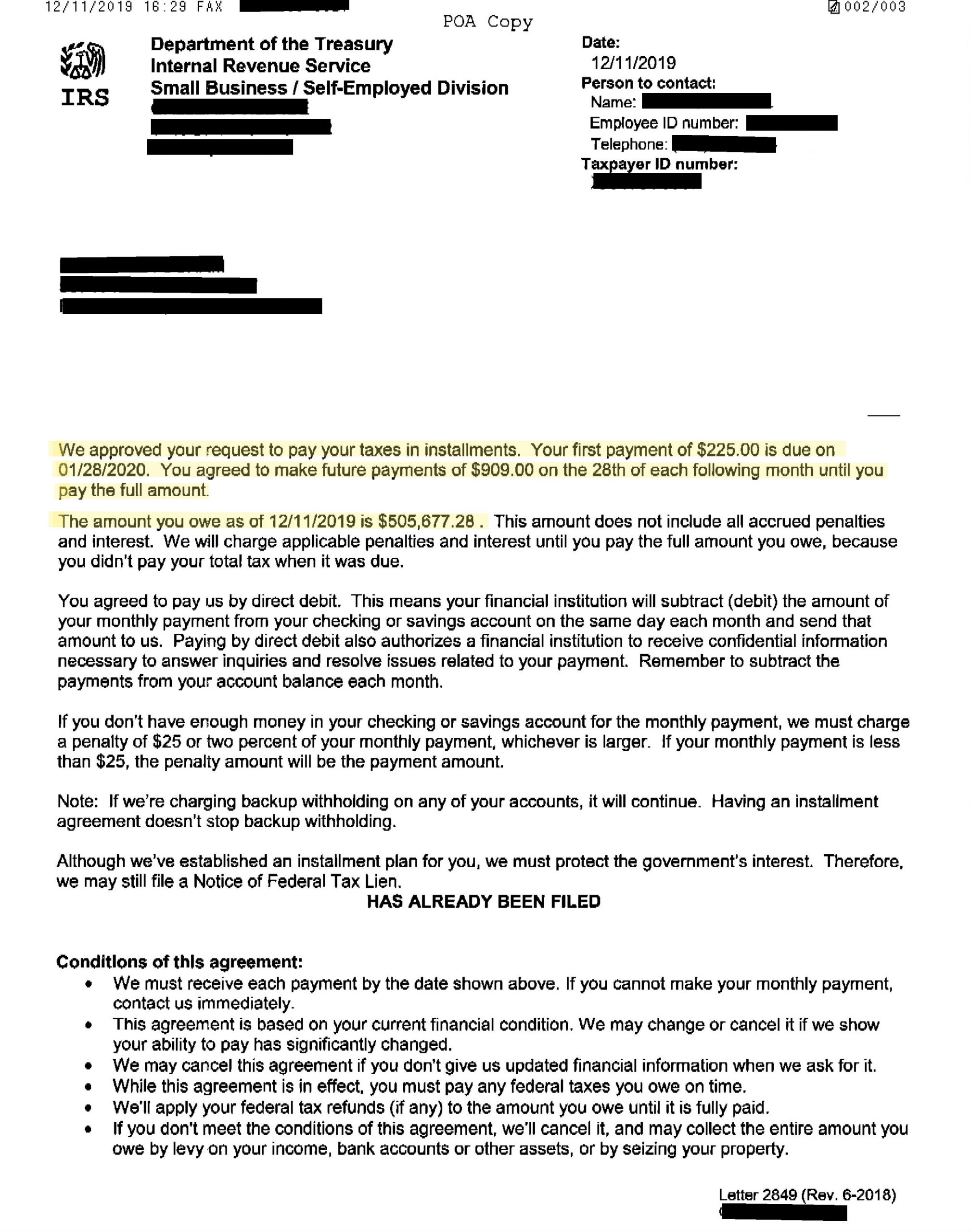

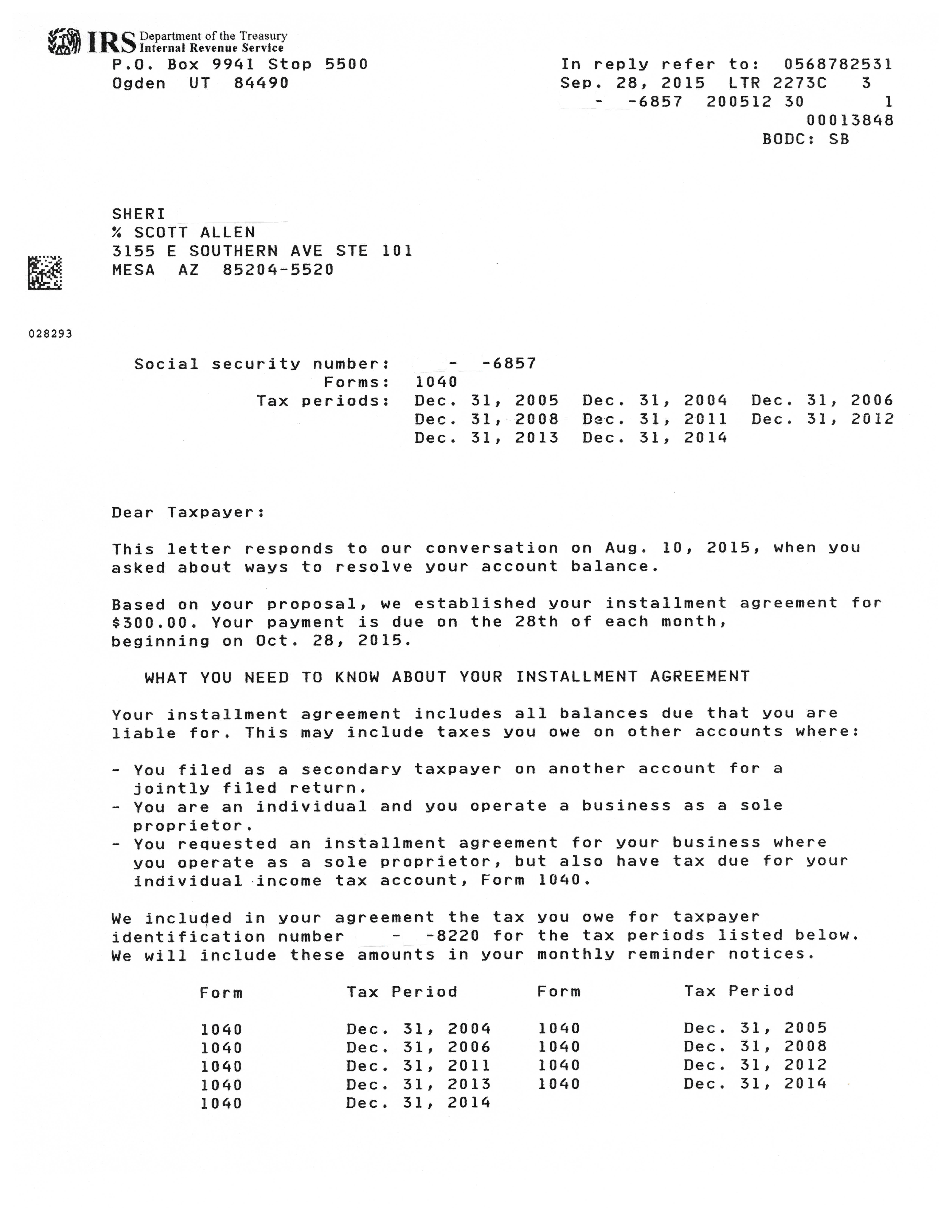

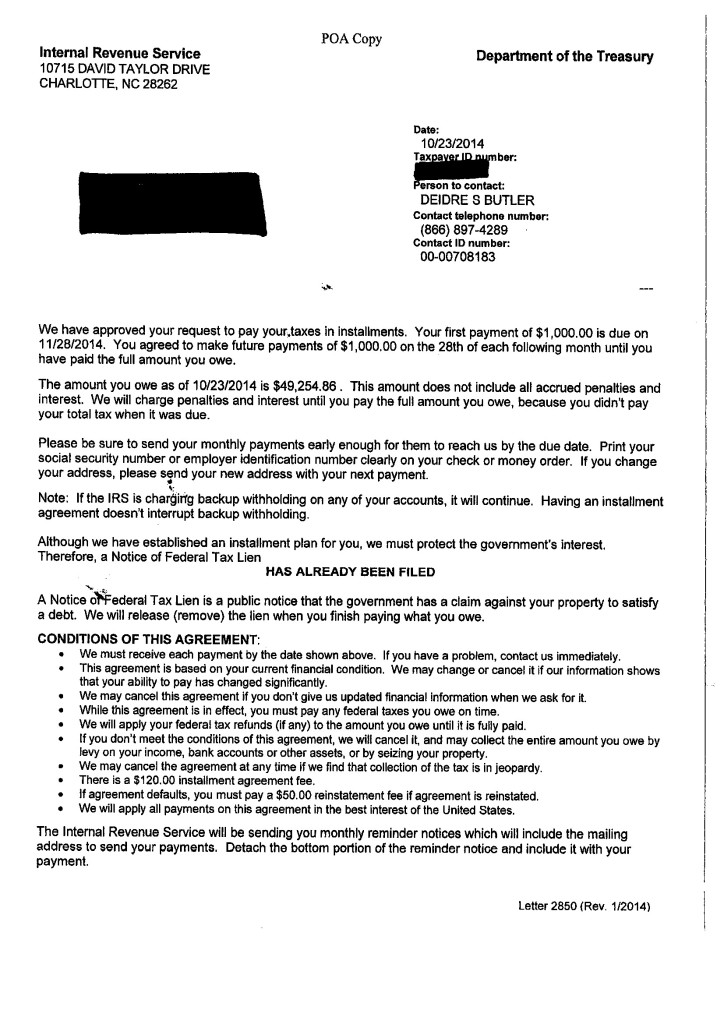

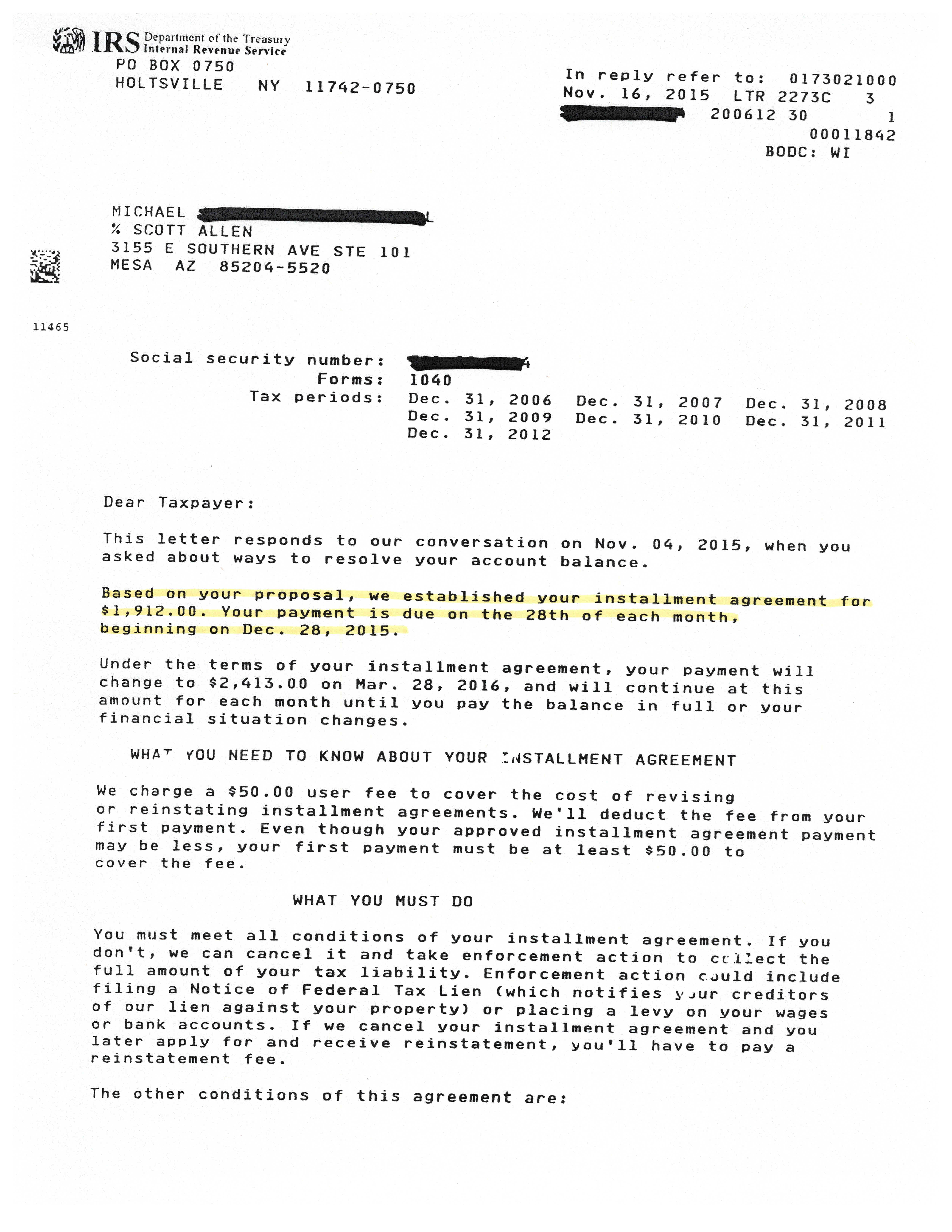

The IRS offers 4 payment plans also known as installment agreements Each installment agreement has its own requirements and benefits. This installment plan will allow any taxpayer who has delinquent or unpaid taxes to process their payments over time while giving them the chance to avoid any levies garnishments or any other possible collection. Types Of IRS Payment Plans.

If you need a payment plan for your taxes visit irs-dot-gov-slash-o-p-a. Make a same day payment from your bank account for your balance payment plan estimated tax or other types of payments. Pay by Bank Account for Free Guest Payment with Direct Pay For individuals only.

The IRS offers both short-term and long-term payment plans. Schedule payments up to a year in advance. It is also known as the Installment Agreement IA.

There are two kinds of IRS payment plans. If you havent filed your tax returns you will not qualify for an IRS payment plan. Again your payment amount must pay off what you owe in 72 months or less.

Pay amount owed in full today electronically online or by phone using Electronic Federal Tax Payment System EFTPS or by check money order or debitcredit card. In addition have a monthly payment amount and due date in mind. Fees apply when paying by card.

Doing so will allow you to reap its unique benefits. Pay by Debit Card Credit Card. IRS payment plans allow taxpayers to repay their tax debt over time.

One can ask the IRS for a payment plan if they believe that they can pay their remaining tax in a fixed period. Pay Now by Bank Account. Its essentially a loan with a bank but instead of Bank of America or Chase being the lender its the US.

Long-term payment plans will vary based on the amount of taxes you owe. To qualify for any IRS payment plan you must have filed all your tax returns. Short-term IRS payment plans must be paid within 120 days or less this is now extended to 180 days under the Taxpayer Relief Initiative.

4 rows An IRS payment plan is an agreement that gives you an extended period of time to pay off the. Costs and fees associated with IRS payment plans. An agreement made with the IRS to pay the tax owed to them is a payment plan.

If youre applying for a long-term payment plan with automatic withdrawals you will pay a 31 setup fee. Taxpayers who owe less than 10000 typically have up to three. An IRS payment plan is an agreement you make directly with the agency to pay your federal tax bill over a certain amount of time.

/9465-700bb91065234917b8d2866f2306afe9.jpg)