Nyc Deferred Compensation Plan

We gratefully acknowledge the cooperation of the New York State Deferred Compensation Plan who provided the information contained in this chapter and who are entirely responsible for its contents.

Nyc deferred compensation plan. The New York Power Authority Deferred Compensation Plan Plan is a voluntary retirement savings program that allows you to save and invest today for your retirement. New York State logo with text labelling the logo specific to Deferred Compensation Plan A Plan for Your Future. Self-Help Guide 8-2 Overview The Deferred Compensation Plan the Plan is a voluntary retirement savings.

Asset managers may be reporting significant amounts of deferred compensation on those returns as a result of the. The New York City Deferred Compensation Plan DCP allows eligible New York City employees a way to save for retirement through convenient payroll deductions. The 457b and 401k sport the same investment menu which does not include a fixed return fund as does the 403b operated.

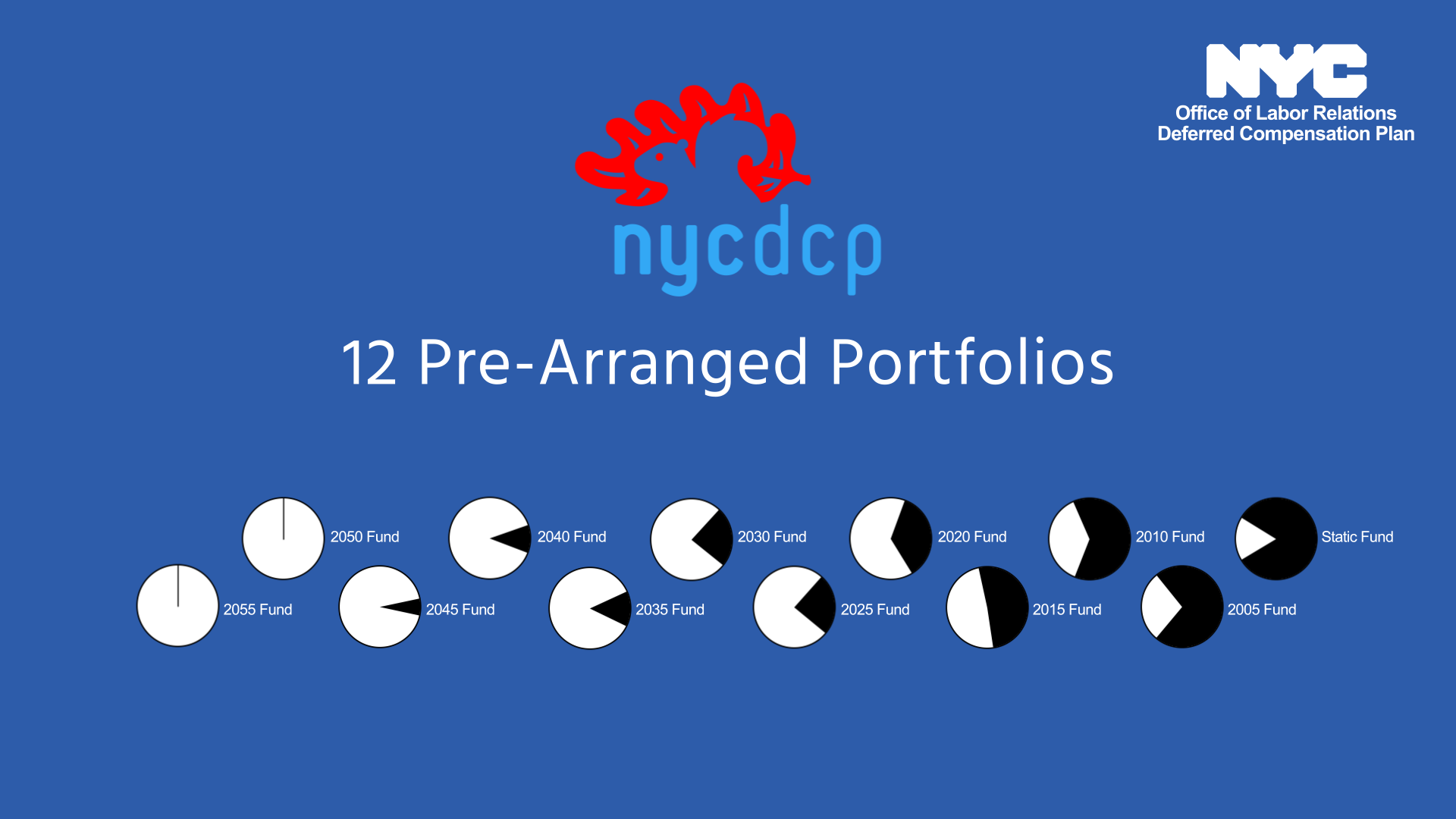

You can choose to sign up for either the 457 or 401k plan or both if eligible. With each plan option. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings.

Therefore a participant should consider other ways to cover unexpected expenses. Federal law allows them to max out the 403b and the 457b during the same year. The New York City Deferred Compensation Plan DCP is a tax-favored retirement savings program available to New York City employees.

You can contact a Plan representative at 212 306-7760. Comparing Programs The chart below highlights the similarities and differences between the 457 Plan and the 401k Plan as well as contributing on a pre-tax and. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

New York City Deferred Compensation Plan 212 306-7760 Outside NYC. New Rules For Non-Qualified Deferred Compensation. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings.

Your earnings accumulate tax-free and stay in your account while you are a City employee. Interest rate declared quarterly and subject to change. The Plan is comprised of two programs.

Due to the closure of the office if you mailed or faxed forms or correspondance March 11 2020 or after we cannot access or process that form. In the alternative they can max out the 457b and 401k in the same year. New York City Deferred Compensation Plan Designed for iPhone 47 65K Ratings.

1 EMAIL THE PLAN. Deferred Compensation Retirement Planning Brochure. September 17 is the deadline for filing 2017 federal partnership returns that are on extension as many are and so the time for filing is now upon us.

457b and 401k are offered by the Deferred Compensation Plan of the City of New York. The Citys Deferred Compensation Plan DCP is a tax-favored retirement account that lets you save for the future through easy payroll deductions. While similar to the Employees Savings Plan our 401k plan the Deferred Compensation Plan has.

Taking a loan from hisher Deferred Compensation Plan account can greatly impact ones future account balance. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings. Both plans offer pre-tax and Roth after-tax options.

The Maximum Loan Amount a participant may obtain is the lesser of. A 457 Plan and a 401 k Plan and is an essential part of your retirement income. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

This is an effective annual yield. 1 For FrontLine Deferred Compensation Plans the interest rate may be less depending on the plan selected. For more information please visit the OLR website.

New York Tax Update. 888-DCP-3113 Customer Service Center. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers.

The New York City Deferred Compensation Plan has two programs the 457 plan and 401k plan. Inquiries and questions should be. This plan is administered by The Office of Labor Relations OLR.

The 457 Plan. Featuring the Retirement Calculator youll see your estimated monthly income goal in retirement and progress toward that goal. A voluntary retirement savings plan that provides quality investment options investment educational programs and related services to help State and local public employees achieve their retirement savings.

NYC Deferred Compensation Plan Whether youre on the go a little or a lot the NYC DCP mobile app allows you to view and manage your 457 401k or NYCE IRA accounts whenever and wherever you want. Please resubmit your documents as follows. NYC Deferred Compensation Plan Whether youre on the go a little or a lot the NYC DCP mobile app allows you to view and manage your 457 401k or NYCE IRA accounts whenever and wherever you want.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Due to the closure of the office if you mailed or faxed forms or correspondence March 11 2020 or after we cannot access or process that form. Please resubmit your documents as follows.

The Deferred Compensation Plans client service walk-in center is closed. 22 Cortlandt Street 18th Fl New York NY 10007 nycgovdeferredcomp. The DCP is comprised of two programs.

1 Inquries and questions can be sent via email to the. 2 Nationwide offers the Participant Solutions Center through our affiliate. The Deferred Compensation Plans client service walk-in center is closed.

As a City employee you may also choose to invest in the NYCE IRA which is an individual retirement account with no sales charges and low investment management fees. The minimum loan amount available from either the 457 or the 401k Plan is 2500.