Ny 529 Direct Plan

Ny529 gives you many ways to.

Ny 529 direct plan. Setting up an account is easy. This document includes investment objectives risks charges expenses and other. Industry average 529 expense ratio.

Its never too early to get growing. Age-based portfolios based on a desired level of risk conservative moderate aggressive that automatically shift to more conservative investments as the beneficiary gets closer to college. It offers low fees and diverse investment options featuring Vanguard mutual funds.

Participants can deduct up to. Fees are unusually low there is no minimum contribution and its easy to join and manage your account online. Start saving for your childs education.

New Yorks direct-sold 529 plan offers diverse investment options featuring Vanguard mutual funds. Vanguard serves as the investment manager for this plan. For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837.

It has 013 fees but does not require a minimum contribution and has a high maximum contribution. The NY 529 college savings plan is a state-sponsored investment account for higher education savings. It can be used to pay for four- or two-year colleges postsecondary vocational and trade schools and postgraduate programs.

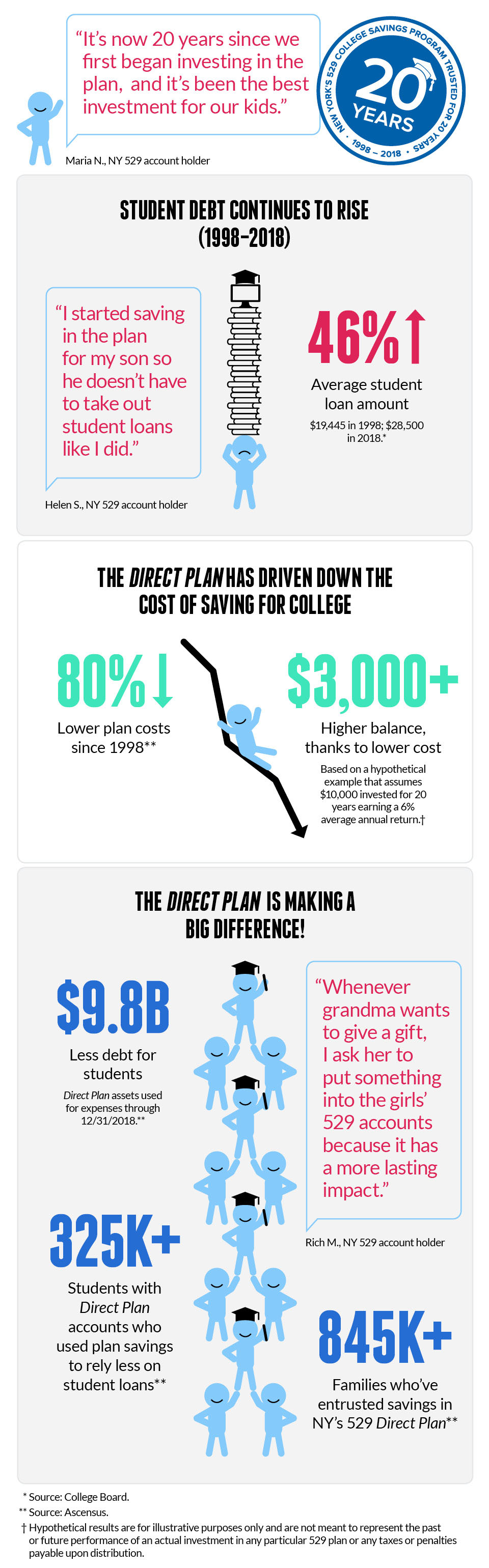

For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837. New Yorks 529 Direct Plan has several advantages compared to other state 529s. Investment returns are not guaranteed and you could lose money by investing in the Direct Plan.

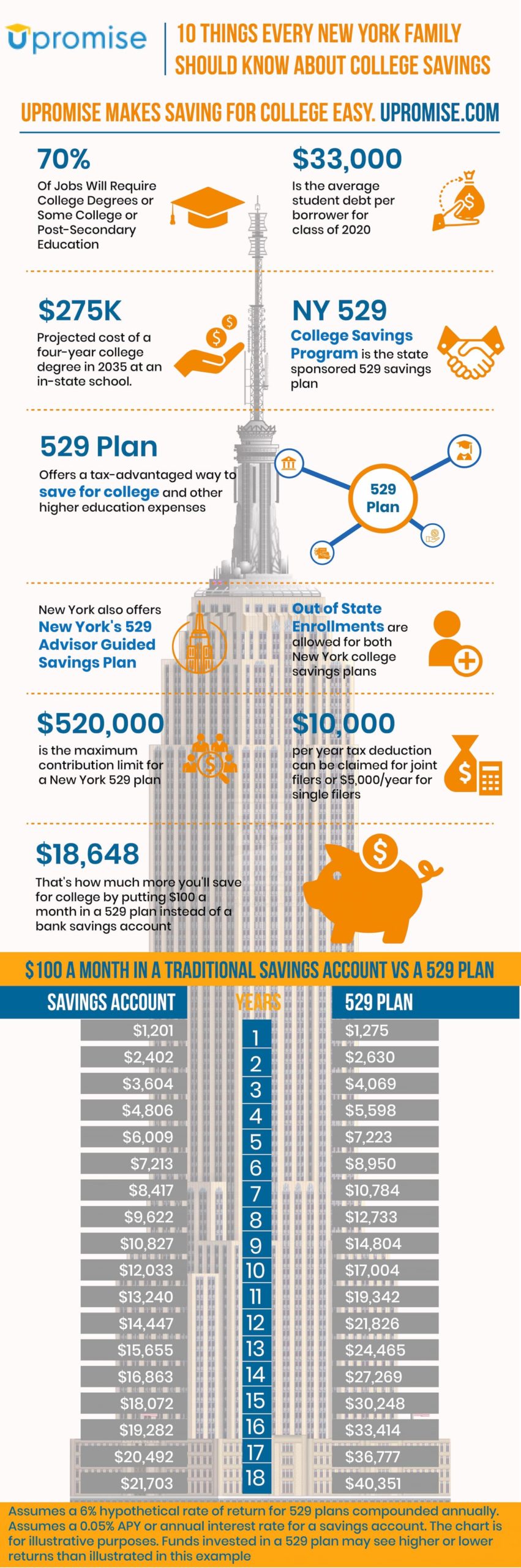

New Yorks 529 College Savings Program currently includes two separate 529 plans. The New Yorks 529 College Savings Program Direct Plan is a direct plan available to residents and non-residents of New York. New Yorks 529 plan comes with a low flat-fee structure.

New York residents may enjoy a state tax deduction for contributions to the plan. NYs 529 College Savings Program Direct Plan. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer.

New Yorks direct-sold 529 college savings plan is available to residents of any state. Where can you use the funds from your NY 529 Direct plan. Use your college savings for tuition books eligible software and more.

31K views October 7. You may also participate in the Advisor-Guided Plan which is sold exclusively through financial advisors and has different investment options and higher fees and expenses as well as financial advisor compensation. This document includes investment objectives risks charges expenses and other.

NYs 529 Direct Plan offers some of the lowest fees available for 529 plans. Learn more about opening an NY 529 Plan for your childs future education today. Get inspiration and support on your savings journey.

The Direct Plan is sold directly by the Program. NYs 529 College Savings Program Direct Plan. Investment returns are not guaranteed and you could lose money by investing in the Direct Plan.

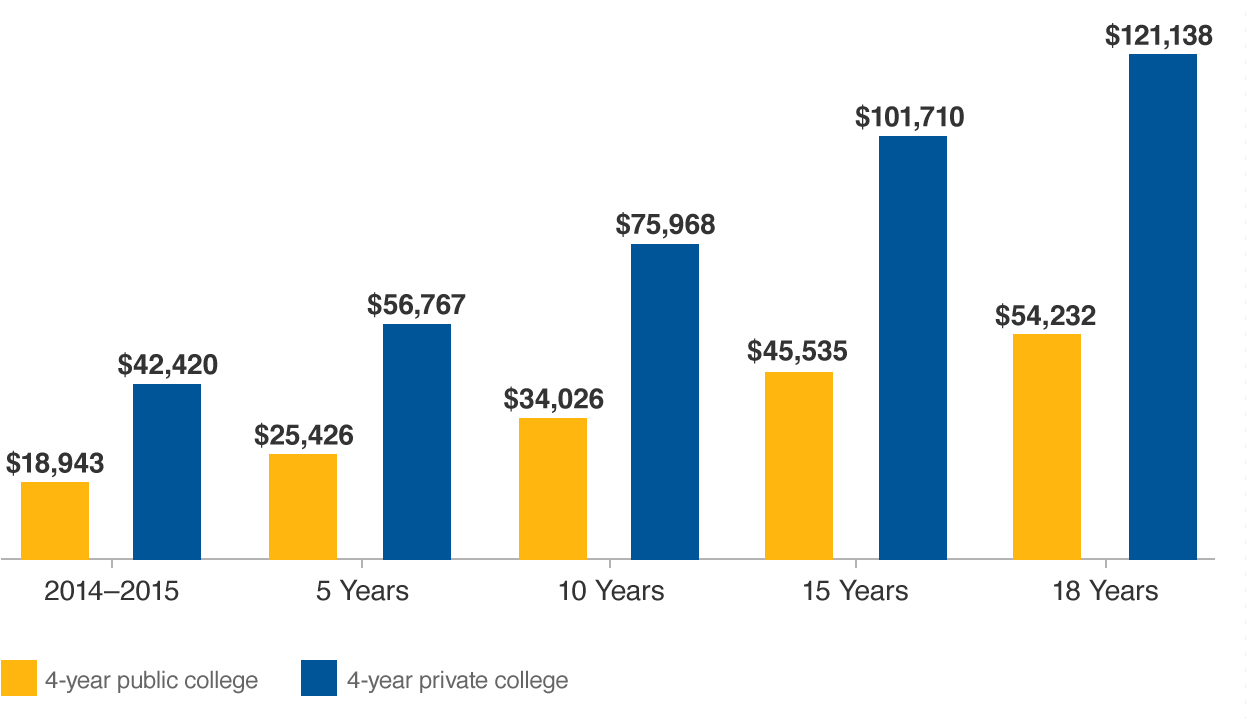

All participants pay an annual program management fee of 013 of the account balance and no other fees. For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837. The NY 529 Direct Plan helps families save in order to avoid years of student.

This document includes investment objectives risks charges expenses and other. Vanguard and Strategic Insights as of March 31 2020. You pay only 130 in fees per year for every 1000 you invest in the plan.

Vanguard average 529 expense ratio. Investment returns are not guaranteed and you could lose money by investing in the Direct Plan. Vanguard managed approximately 987 billion in 529 plan assets as of March 31 2020.