Nonqualified Deferred Compensation Plan

A non-qualified deferred compensation plan or agreement simply defers the payment of a portion of the employees compensation to a future date.

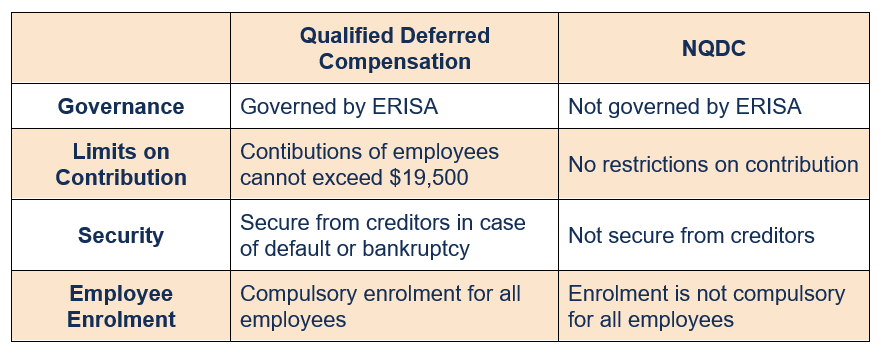

Nonqualified deferred compensation plan. Ii a plan maintained primarily for the purpose of providing deferred compensation for a select group of management or highly compensated employees top-hat plan under ERISA 2012 301a3 and 401a1. Its like a 401k or 403b in that contributions are made through payroll deductions and are tax deferred but they differ in a few other important ways. In comparison with qualified plans nonqualified plans do not provide.

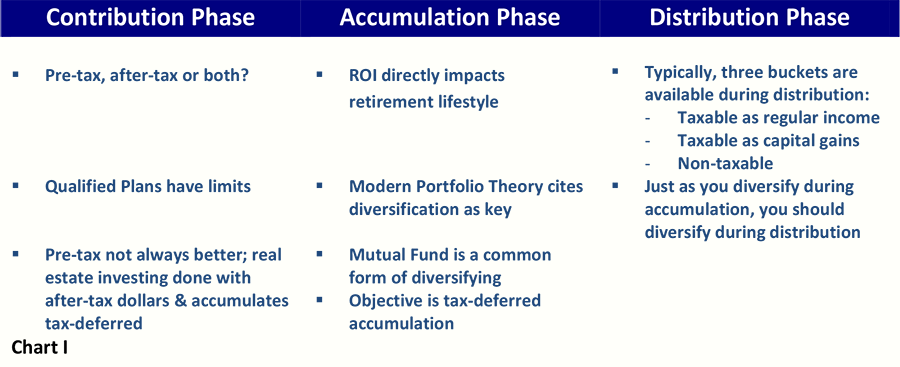

With a deferred compensation plan the employee will not owe income tax until the payment is actually. They differ drastically from qualified plans like 401 ks. A lesser-known nonqualified deferred compensation plan is the 457 plan.

There are four major types of non-qualified plans. A non-qualified deferred compensation NQDC plan is a type of non-qualifying plan that falls outside the Employment Retirement Security Income Act ERISA Employee Retirement Income Security Act ERISA The Employee Retirement Income Security Act ERISA is a federal law that was created to protect individuals who are covered through. This Plan is intended to constitute a deferred compensation plan that complies with the requirements of Code section 409A and its corresponding regulations and is intended as a plan for a select group of management or highly compensated employees within the meaning of.

NQDC plans sometimes known as deferred compensation programs or DCPs or elective deferral programs or EDPs allow executives to defer a much larger portion of their compensation and to defer taxes on the money until the deferral is paid. While NQDC plans have fewer restrictions than qualified broad-based retirement plans they must satisfy a number of conditions. However these plans make sense for some employees usually top executives and high-income earners who are interested in the potential tax advantages these plans provide.

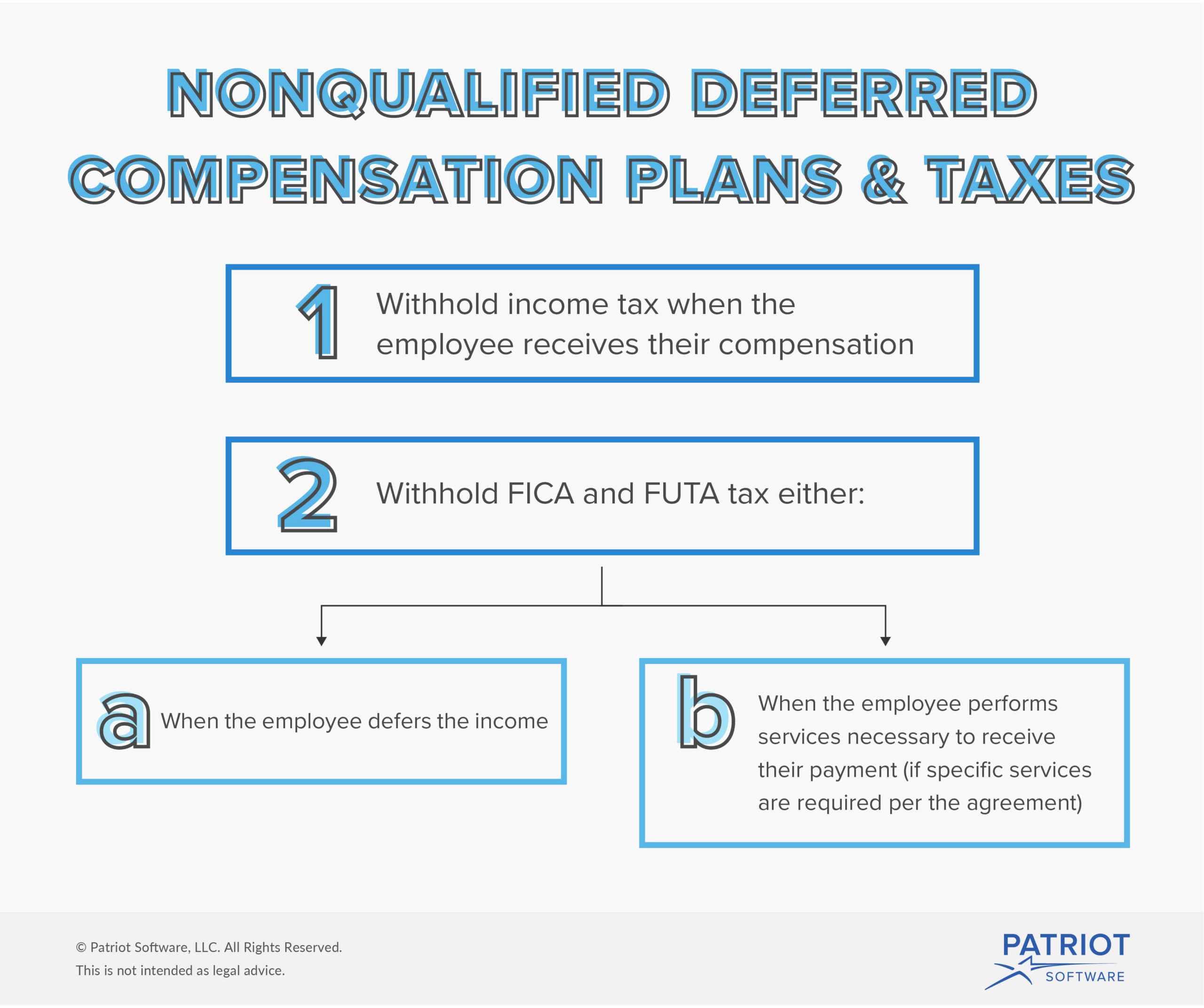

A nonqualified deferred compensation NQDC plan is a broad general description for any arrangement under which the employer or the employee can defer taxation of compensation that is earned in one year so that it becomes included in taxable compensation in a later year because payment occurs more than 2½ months after the year in which the benefit. As will be discussed later one of the keys. With a nonqualified deferred compensation NQDC plan your employees can defer some of their pay until a later date.

This insightful report provides guidance on numerous aspects of nonqualified deferred compensation plans with regard to issues of the COVID-19 pandemic. You can offer your employees two types of deferred compensation plans. With socioeconomic and regulatory landscapes changing day by day and sometimes hour by hour both plan providers and plan participants are faced with new and unexpected issues.

A nonqualified deferred compensation NQDC plan is an arrangement that an employer and employee agree to where the employer accepts to pay the employee sometime in the future. What Is a 457 Plan. Non-qualified deferred compensation plans wont be appealing to all employees.

Iii a plan only for Contractors. I an excess benefit plan under ERISA 336. If your employer offers a nonqualified deferred compensation NQDC plan you might want to explore this option.

Offered only by state and local governments and some nonprofits 2. More Retirement Contribution Definition. Deferred compensation for Eligible Employees of the Company.

Nonqualified deferred compensation NQDC plans are a flexible way to attract retain and motivate executives management teams and other key employees. These nonqualified plans are. Nonqualified Deferred Compensation NQDC Plans are used by plan sponsors who want to give back to valued employees whose leadership and expertise are hard to match.

A nonqualified deferred compensation NQDC plan is an elective or non-elective plan agreement method or arrangement between an employer and an employee or service recipient and service provider to pay the employee compensation in the future. A nonqualified plan is a tax-deferred employer-sponsored retirement plan that falls outside of Employee Retirement Income Security Act guidelines. NQDC plans are also known as.

A nonqualified deferred compensation plan is an unfunded plan that may be. It allows the employee to defer the receipt of income that is currently earned. The amounts are held back while the employee is working for the company and are paid out to the employee when he or she separates from service becomes disabled dies etc.

This type of deferred compensation plan typically pays out income after an employee leaves their job like in retirement for instance.