Is A 401k A Defined Contribution Plan

The percentage of your eligible compensation you elect will be withheld from each payroll and contributed to an Account in the Plan on your behalf.

Is a 401k a defined contribution plan. The reason is that this is a deferral that was elected by the employee. You may elect to defer a percentage of your eligible compensation into the Plan. These plans were designed to allow employees to direct a portion of their income into the plan on a pre-tax basis.

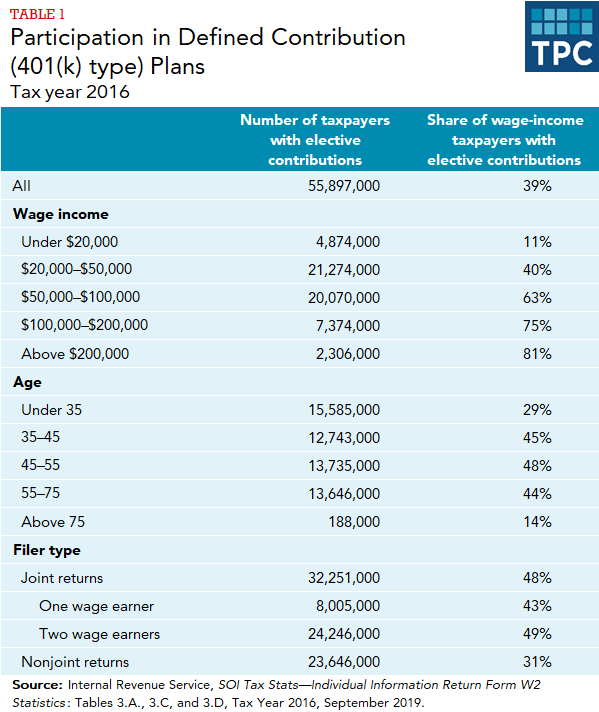

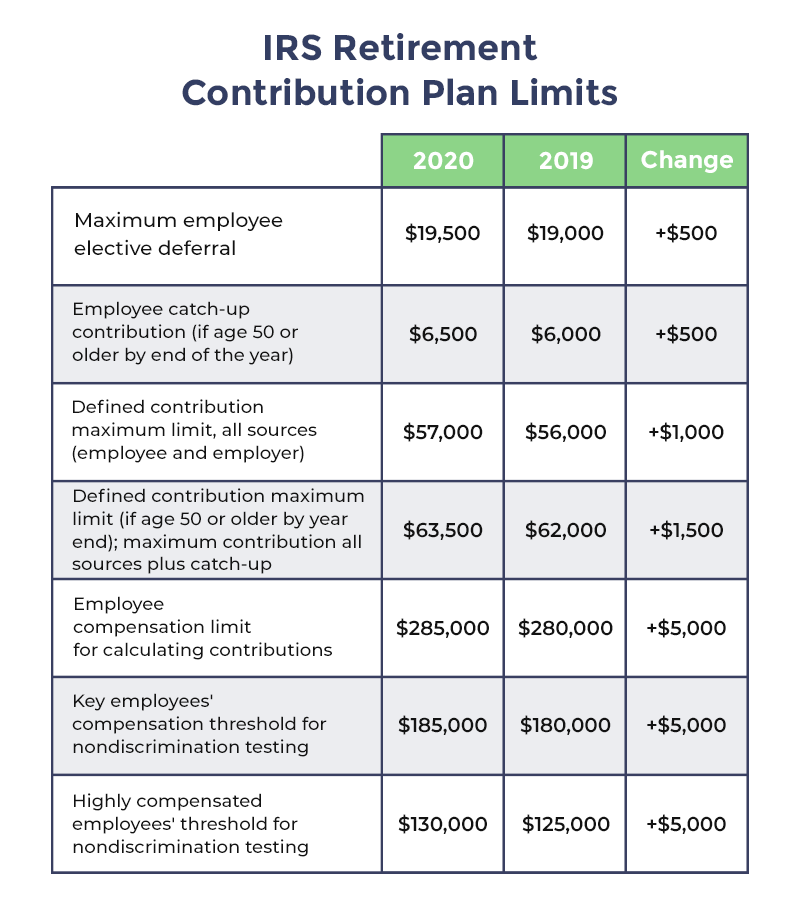

The 401k is a type of defined contribution plan that can be used by employees and by self-employed workers. Employees can contribute their wages to their 401K. A 401 k is a defined contribution plan which means there are uniform limits on how much can be contributed each year on each participants behalf be it the participants own contributions the employers contributions on their behalf or a combination of the two.

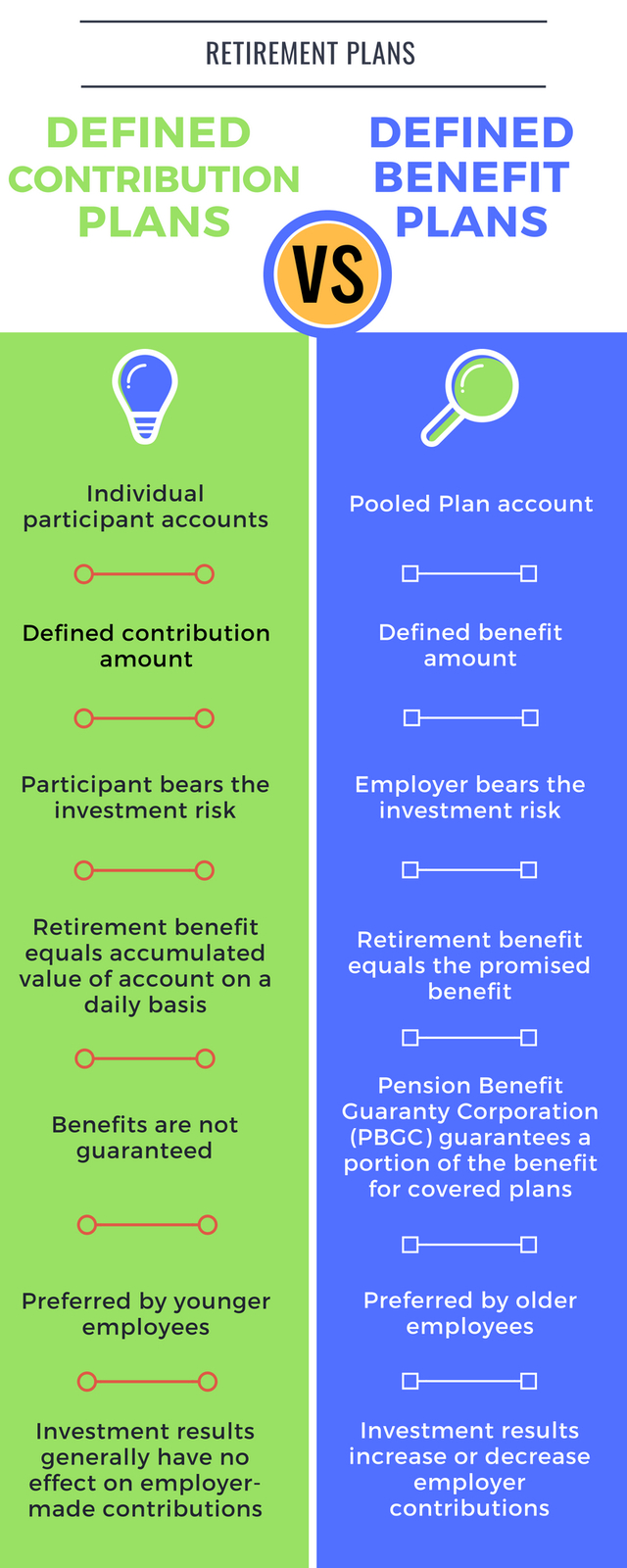

A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. A defined contribution plan on the other hand does not promise a specific amount of benefits at retirement. This money is taken out before the employees paycheck is taxed.

It is not a company contribution like a defined benefit plan. A defined benefit plan also called a pension. For 2020 the maximum amount that an employee can contribute is 19500 plus an additional 6000 catch-up contribution if the employee is at least 50 years old.

Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts through employee contributions and if applicable employer contributions plus any investment earnings on the money in the. There is actually no restriction on the employee 401k deferral. Unlike a pension plan which provides a defined benefit the individual defines the contributions to a 401 k plan and no guarantee exists as to the eventual benefit.

This allows a contribution of 19500 for employees under the age of 50 and 26000 for those 50 and older. It is called a 401K due to the IRS Internal Revenue Code that allows an employer to create a retirement plan for their employees. Employee 401k contribution are automatically deducted from their paycheck each pay period.

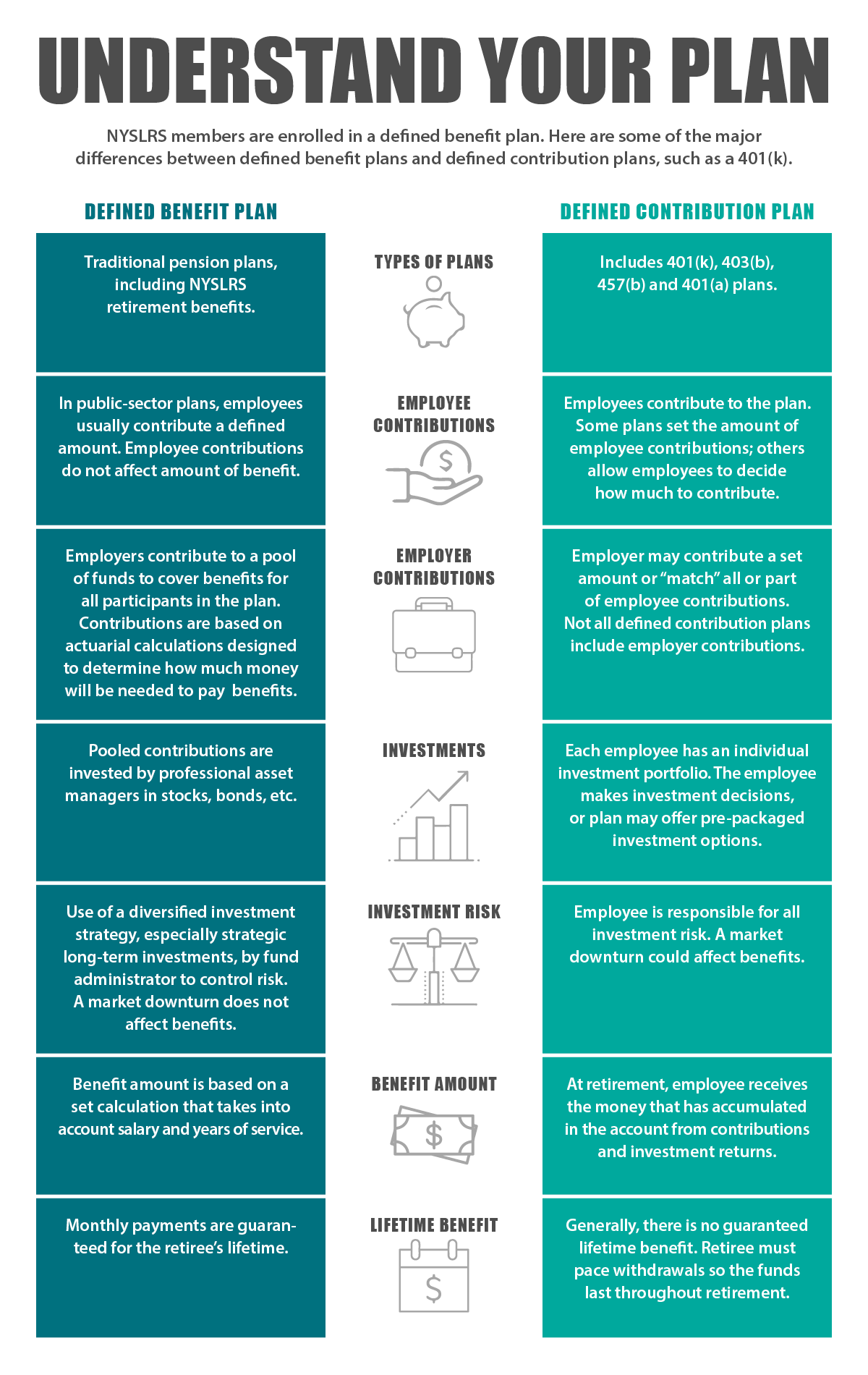

Effective January 1 2015 the Defined Contribution Plan was converted to also be a 401K Plan. Examples of defined contribution plans include 401k plans 403b plans employee stock ownership plans and profit-sharing plans. PENSION DEFINED CONTRIBUTION PLAN.

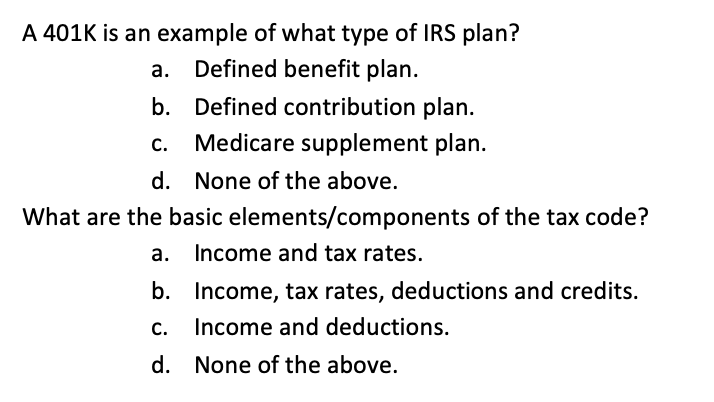

A defined-contribution plan DC is a retirement plan that is typically tax-deferrable. Updated on November 8 2021. A 401 k is a defined contribution plan.

The defined benefit plan is. Is a defined contribution pension plan good. 401 k Plan is a defined contribution plan where an employee can make contributions from his or her paycheck either before or after-tax depending on the options offered in the plan.

A 401K is a tax deferred defined contribution retirement plan that has been around since 1978. A defined contribution DC plan is a type of retirement plan in which the employer employee or both make contributions on a regular basis. A defined contribution plan may be known as a group RRSP.

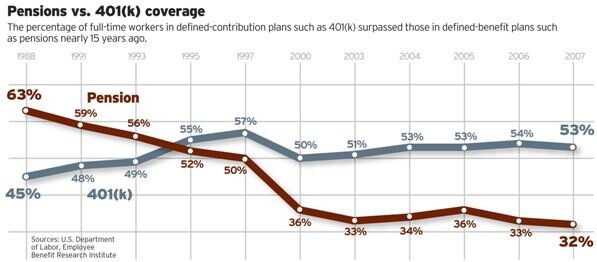

Defined contribution plans are the most widely used type of employer-sponsored benefit plans in the United States. 401K defined contribution plans can help you meet your goals for retirement. No a 401k plan is not a defined benefit plan.

With this type of plan you have the ability to contribute up to 16500 per year out of your annual income as of 2010. The employee will contribute of a minimum of 8 of regular earnings. The contributions that you make to the.

The contributions go into a 401 k account with the employee often choosing the investments based on options provided under the plan. A 401k and 403b are both DC plans that are tax-deferrable. Meaning until the owner does something with the money they wont have to pay taxes on the investment until then.

In 1978 section 401k of the Internal Revenue Code authorized the use of a new type of defined contribution plan that allows for the employee to make pre-tax contributions to the plan. These defined contribution plans are where the employee contributes a percentage or a. Police Officers hired after July 1 2010 will be enrolled in a Defined Contribution 401 a Money Purchase Plan which is a retirement savings plan which allows contributions to be made by the employer and the employee.

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)