Is 401k A Retirement Plan

Plan data indicates that the law is.

Is 401k a retirement plan. Retirement is a lot more complicated than it used to be. Retirees must find suitable. You may choose a different contribution amount choose to make Roth 401 k contributions or opt out at any time.

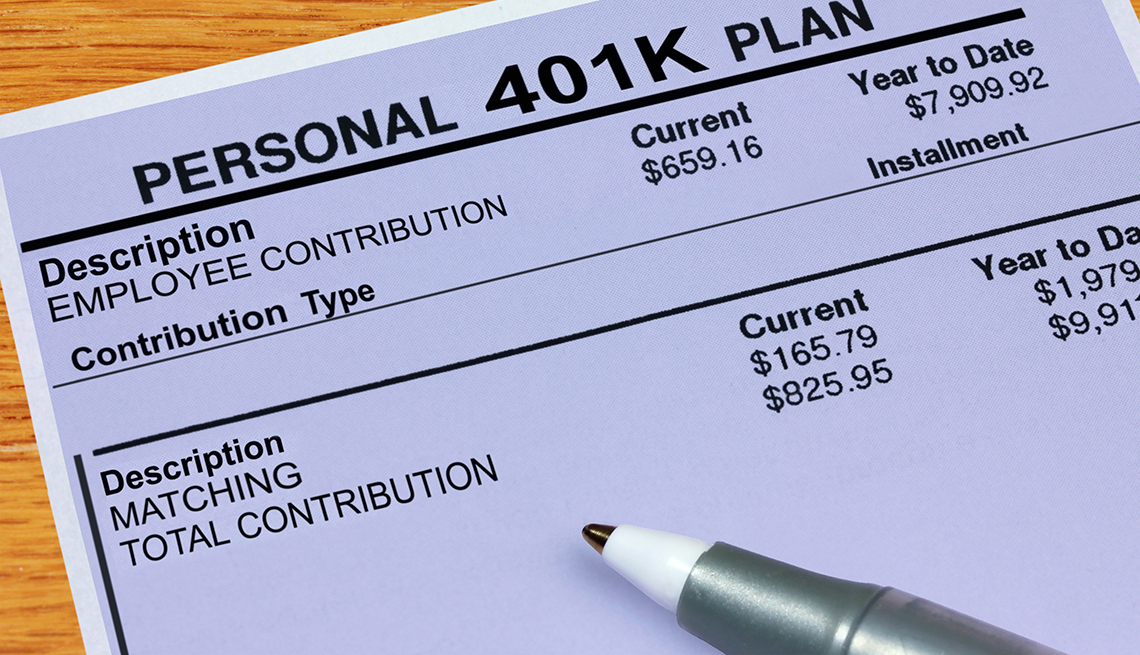

But improving your investing know-how in 2022 could be the difference-maker in your retirement plan. The employee who signs up for a 401k agrees to have a percentage of each paycheck paid directly into an investment account. 401k plan qualification rules.

A 401k plan is a tax-advantaged retirement account offered by many employers. Employees age 21 or older are automatically enrolled in the plan at a pretax contribution rate of 6 after completing 1000 hours of service. A 401 k is a retirement savings account that allows you to defer paying income taxes on contributions until your retirement.

A 401k plan is a tax-advantaged retirement account offered by many employers. The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements IRAs to contribute to Roth IRAs and to claim. There are two basic typestraditional and Roth.

Empower Retirement is the record keeper for the Companys 401 k plan. Distributions including earnings are. The popularity of 401k savings plans has turned millions of Americans into their own pension plan managers.

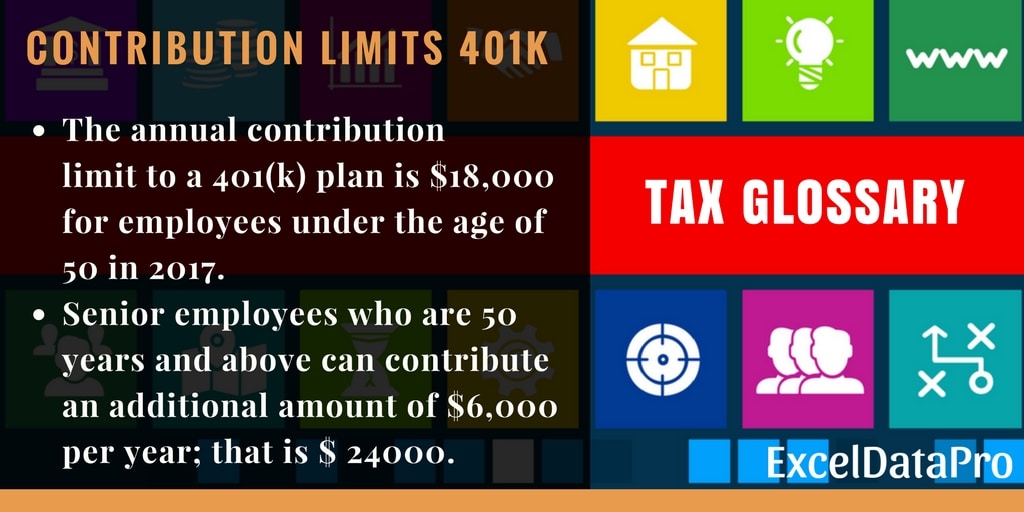

The contribution limit for employees who participate in 401k 403b most 457 plans and the federal governments Thrift Savings Plan is increased to 20500 up from 19500. A 401k plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. This attractive benefit isnt just for big companies anymore with a 401 k you can attract top talent retain employees and save on taxes.

The Setting Every Community Up for Retirement Enhancement SECURE Act aimed to increase savings through 401k and similar employer-sponsored retirement plans. Employers can contribute to employees accounts. The employer may match part or all of that contribution.

Its possible to grow a 401k balance without a high level of investing skill and expertise. There are two basic typestraditional and Roth. A 401 k is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts.

Leverage 401 k Planstin has made it easy to offer a retirement plan for your employees. Publication 560 Retirement Plans for Small Business SEP SIMPLE and Qualified Plans Publication 4222 401k Plans for Small Businesses PDF Guide to Common Qualified Plan Requirements. Funds withdrawn from your 401 k plan before age 59 12 are taxed as ordinary income and you may have to pay a 10 federal tax penalty for early withdrawal.

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

/GettyImages-186848586-5728ea435f9b589e34c6081c.jpg)

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)