In A Qualified Retirement Plan, The Yearly Contributions To An Employee's Account

MAXIMUM CONTRIBUTION FROM EMPLOYER PARTICIPANT THAT EMPLOYER CAN DEDUCT.

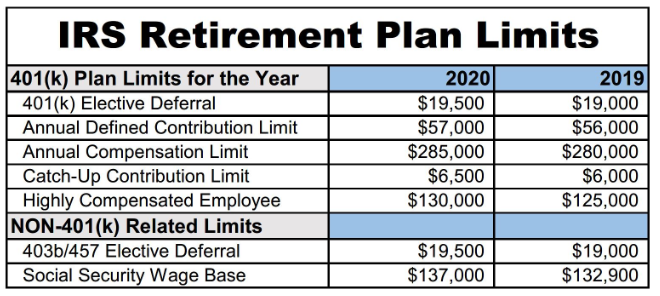

In a qualified retirement plan, the yearly contributions to an employee's account. The Annual Compensation Limit increases from 285000 to 305000. A retirement plan that sets aside part of the companys net income for distributions to qualified employees is called a rollover plan 403b plan profit-sharing plan. In an individual retirement account IRA rollover contributions are subject to capital gains tax.

A catch-up contribution is a payment only taxpayers ages 50 and older can make. Benefit may also be defined based on a cash balance formula in a. IRAs include catch-up contributions similar to 401 k 403 b and 457 plans.

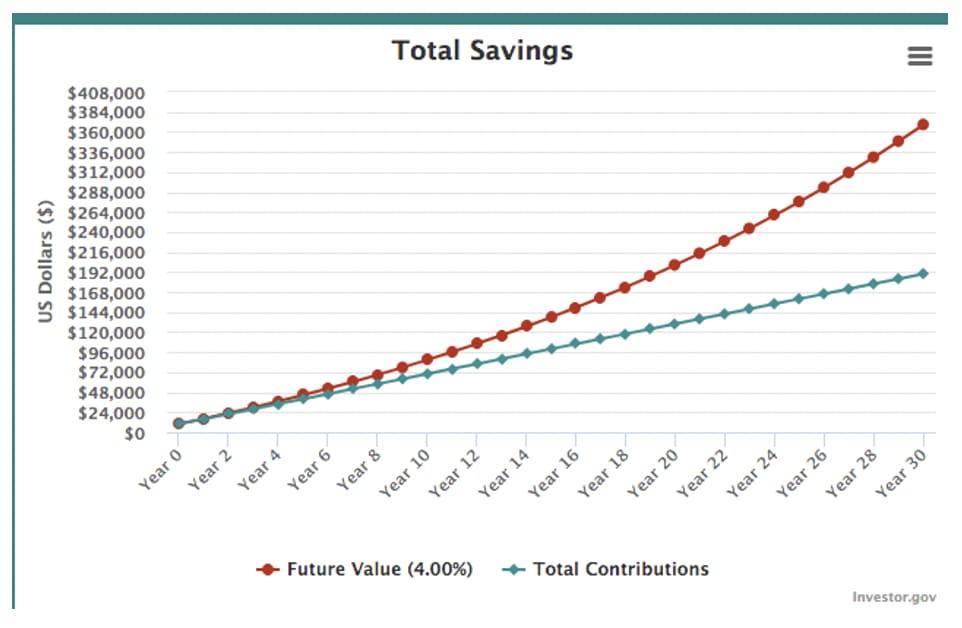

The contributions and earnings then grow tax deferred. Qualified plans come in two main types. The Retirement Plan Company is pleased to present this table for your convenience.

Understanding Qualified Retirement Plans. For married couples filing jointly if the spouse who makes the IRA contribution is an active participant the income. The Total Annual Contribution Limit EEER for defined contribution plans increases from 57000 to 61000.

Limits on contributions to traditional and Roth IRAs remains unchanged at 6000. The plan is funded by elective salary deferrals if employees choose to do so but they require certain employer contributions each year either matching employee contributions up to 3 of. Are restricted to maximum limits set by the IRS.

Are restricted to maximum limits set by the IRS. PARTICIPANT CATCH-UP CONTRIBUTION Up to 6500. The annual benefit limitation for a defined benefit plan is 225000 for 2019 230000 for 2020 and 2021 and 245000 for 2022 subject to cost-of-living adjustments for later years for each employee.

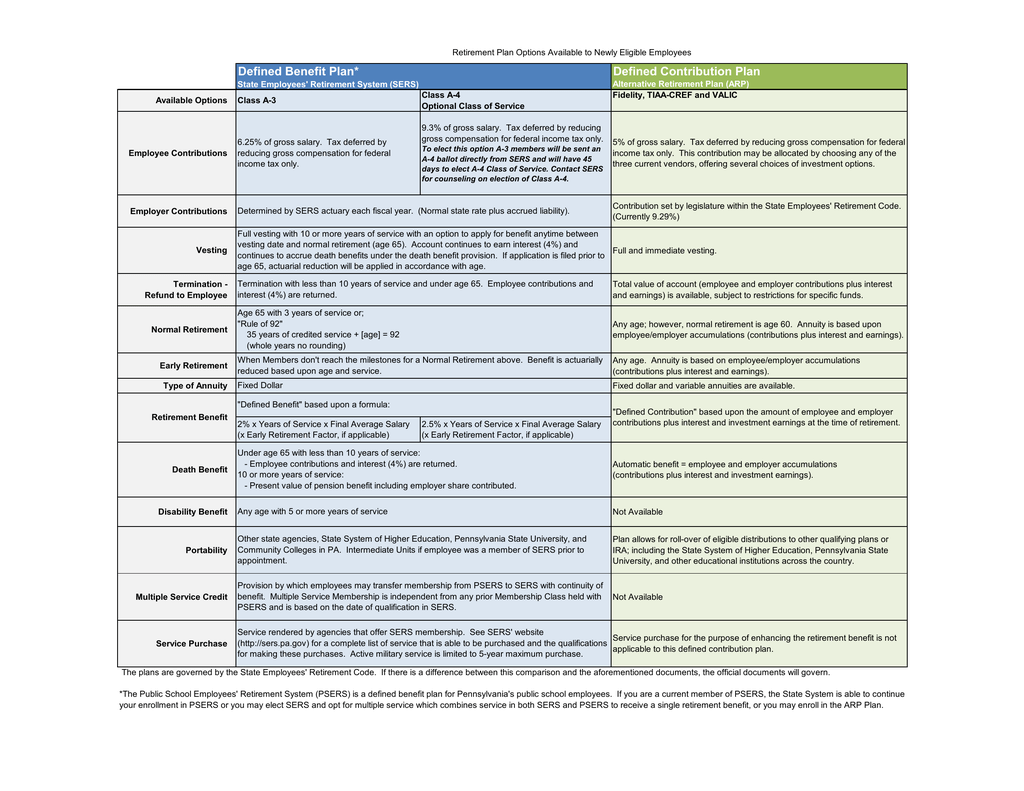

Are restricted to minimum limits set by the IRS. Here are some highlights of your retirement plan options. The IRA contribution limit is the same from 2021 for 2022 at 6000 for the year.

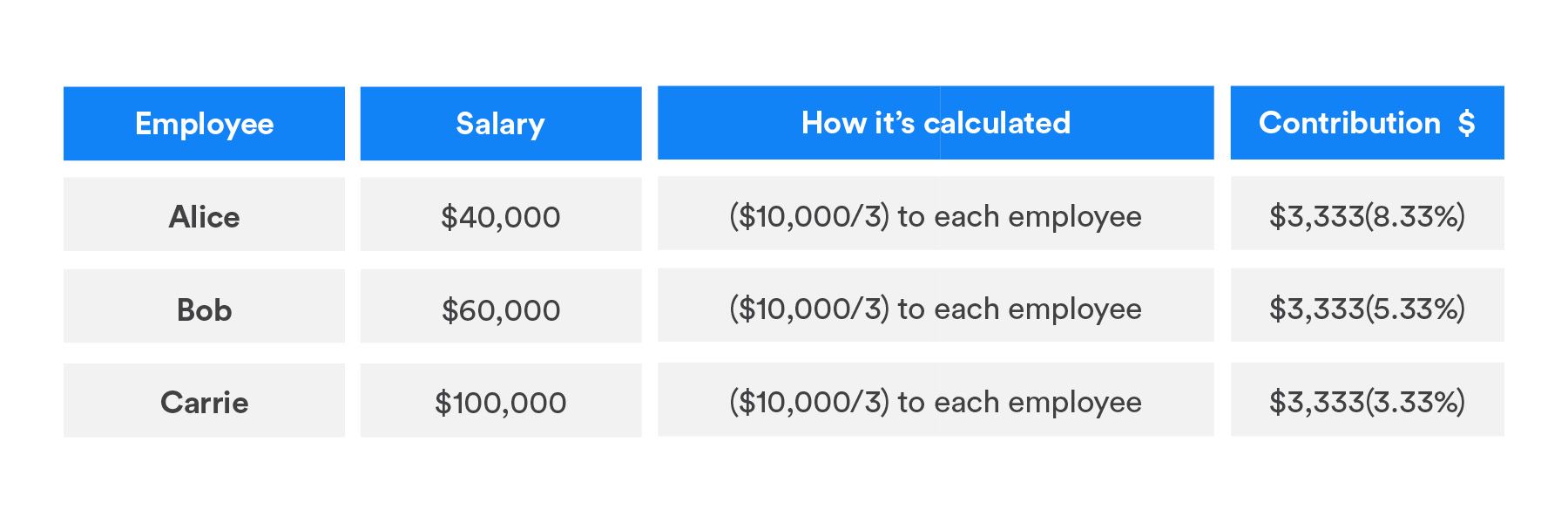

25 of total eligible payroll payroll limited. The maximum annual amount that may be credited to an employees account taking into consideration all defined contribution plans sponsored by the employer is limited to the lesser of 100 of compensation or 54000 in 2017. The limitations on benefits and contributions for retirement plans are set forth in Code section 415.

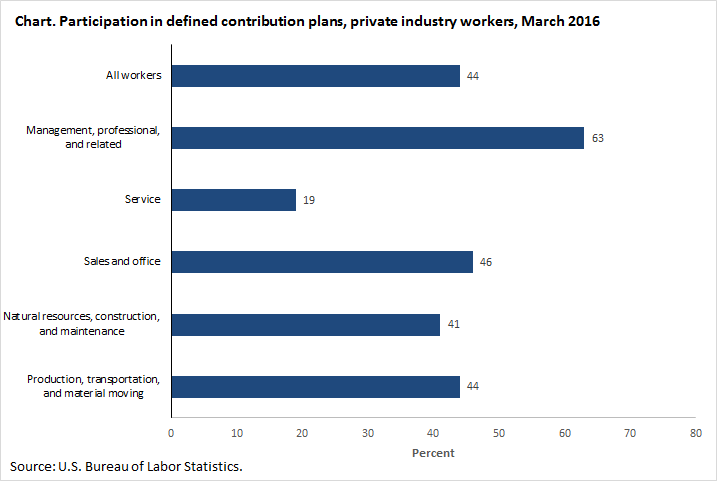

Other defined contribution plans. Active participants in a qualified plan or another retirement plan specified in 219g5 and have adjusted gross incomes as defined in 219g3A between 66000 and 76000 increased from between 65000 and 75000. Allows you to decide how much to contribute on an annual basis.

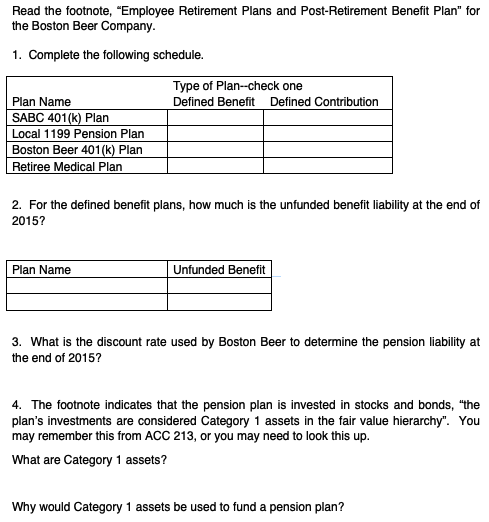

Defined benefit and defined contribution though there are also some other plans that are hybrids of the two the. 8 rows A qualified employee 403a annuity plan. The IRA contribution limits are below.

In a qualified retirement plan the yearly contributions to an employees account. In some cases employers deduct an allowable portion of pretax dollars from the employees wages for investment in the qualified plan. Simplified Employee Pension.

In a qualified retirement plan the yearly contributions to an employees account are not tax-deductible.

/GettyImages-119717074-ea43b342d01b4b859bfbe159201fbcc2.jpg)

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)