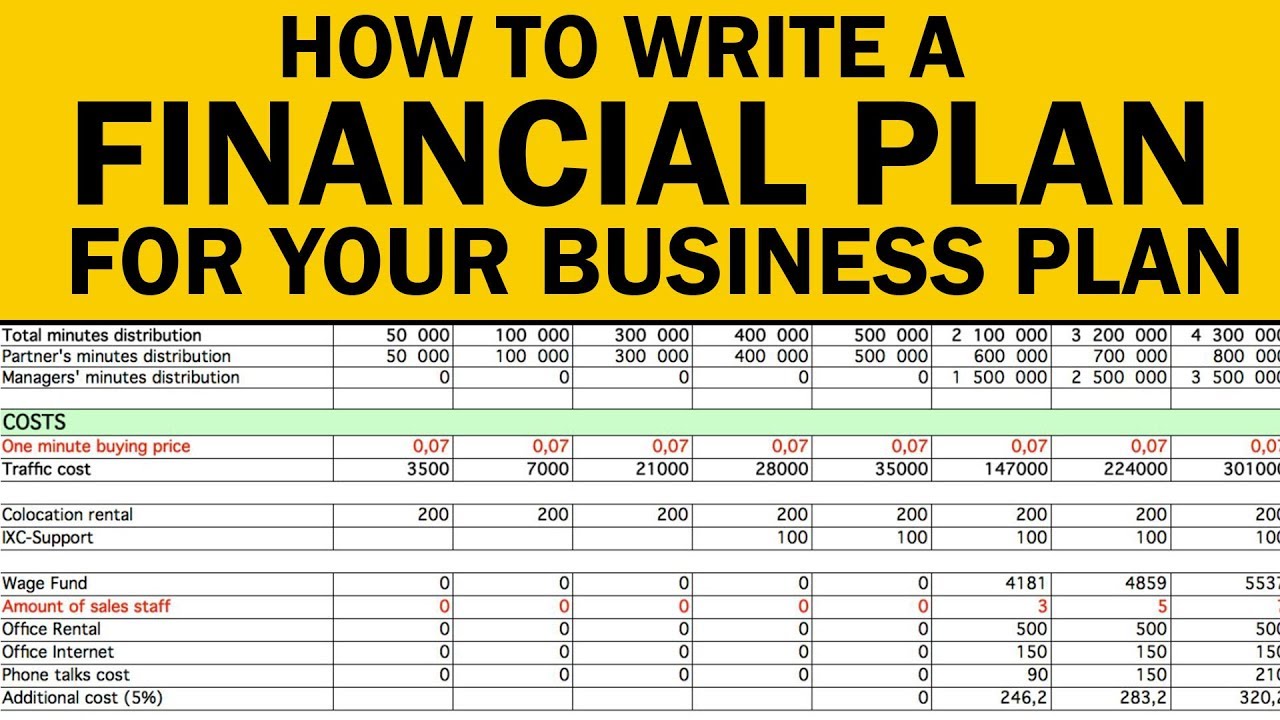

How To Write A Financial Plan

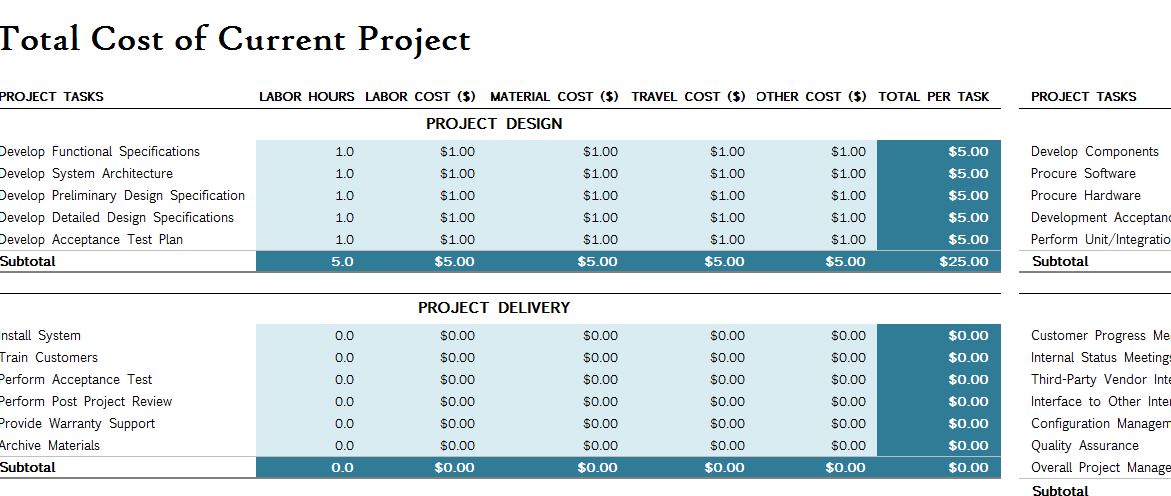

You may need to buy equipment source raw materials or bring in extra help.

How to write a financial plan. 2 Review your expected income for the year. Create and implement your financial action plan 6. The financial plan for startup business is crucial as thats how you are getting the attention of more investors.

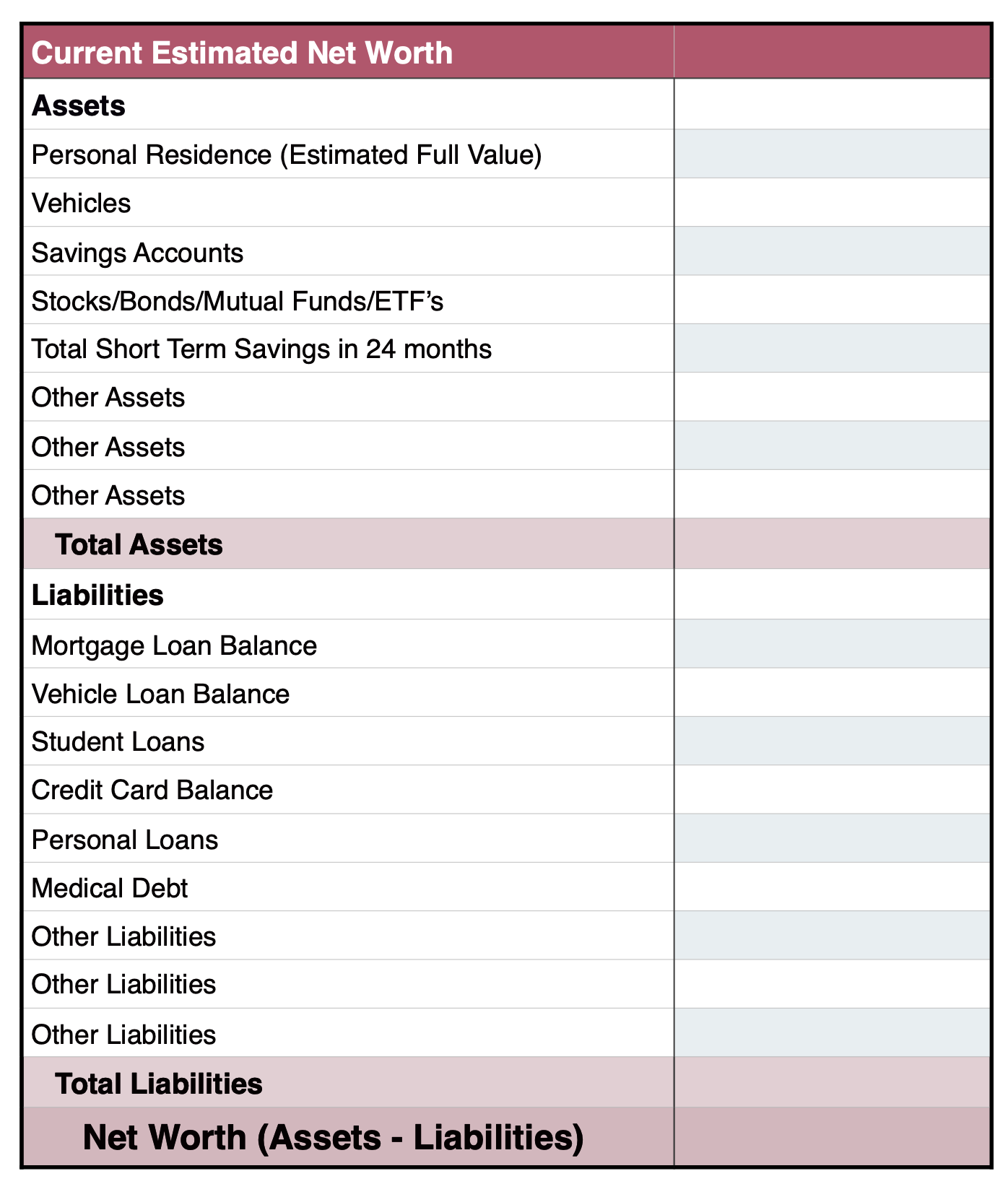

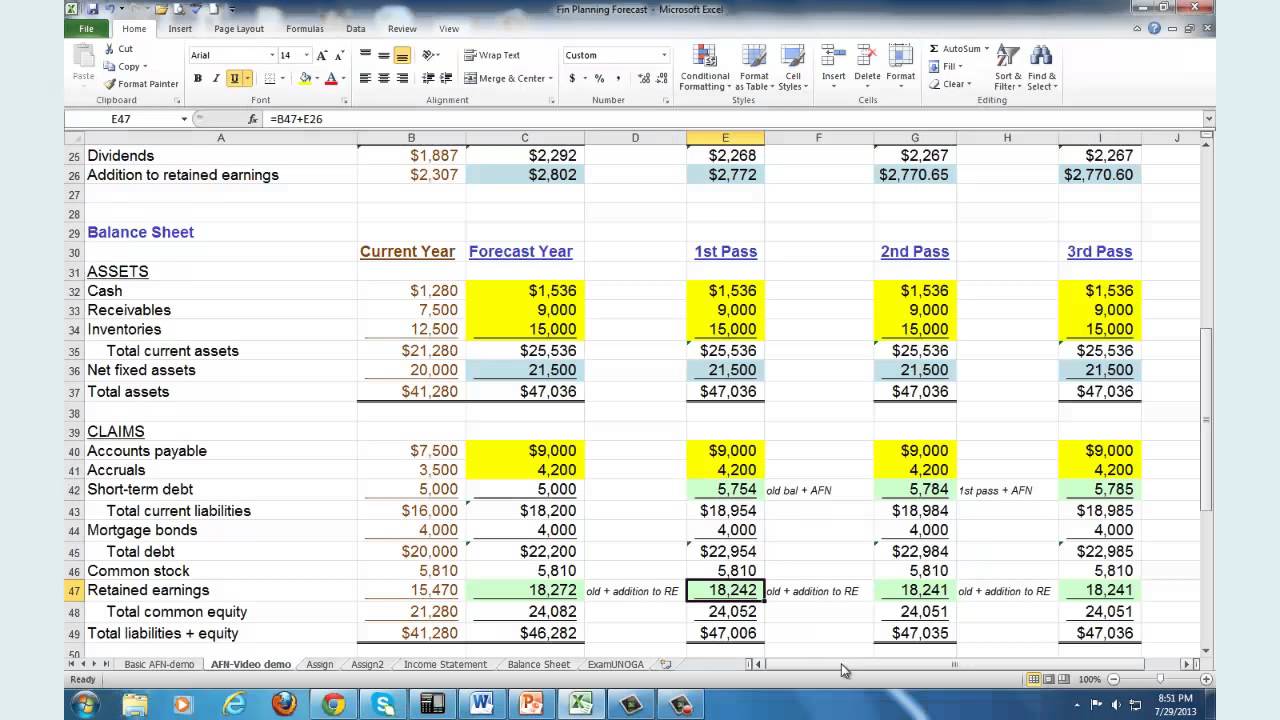

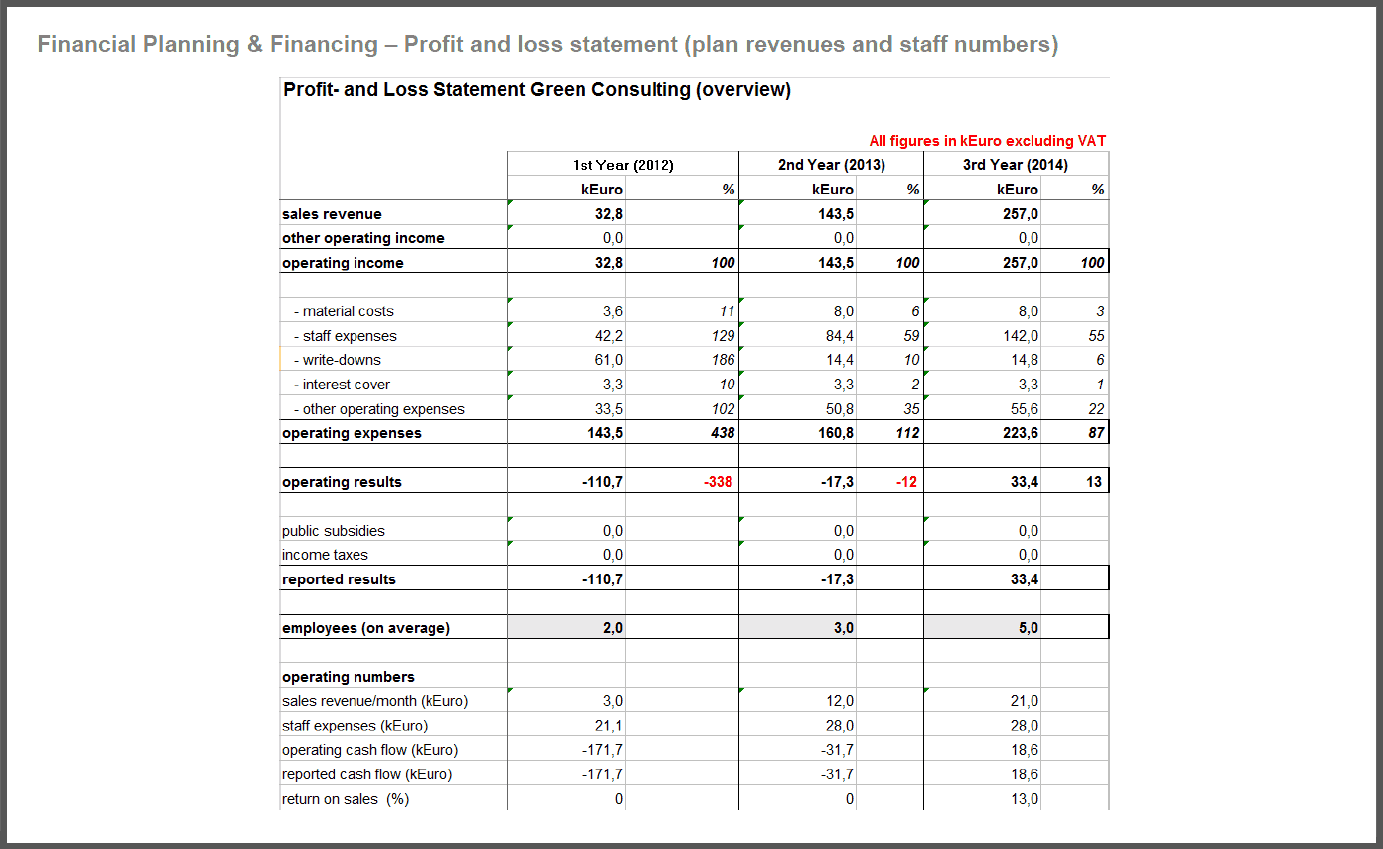

You will want to track this across time. A financial plan can be set up for different periods. Once your balance sheet is complete write a brief analysis for each of the three financial statements.

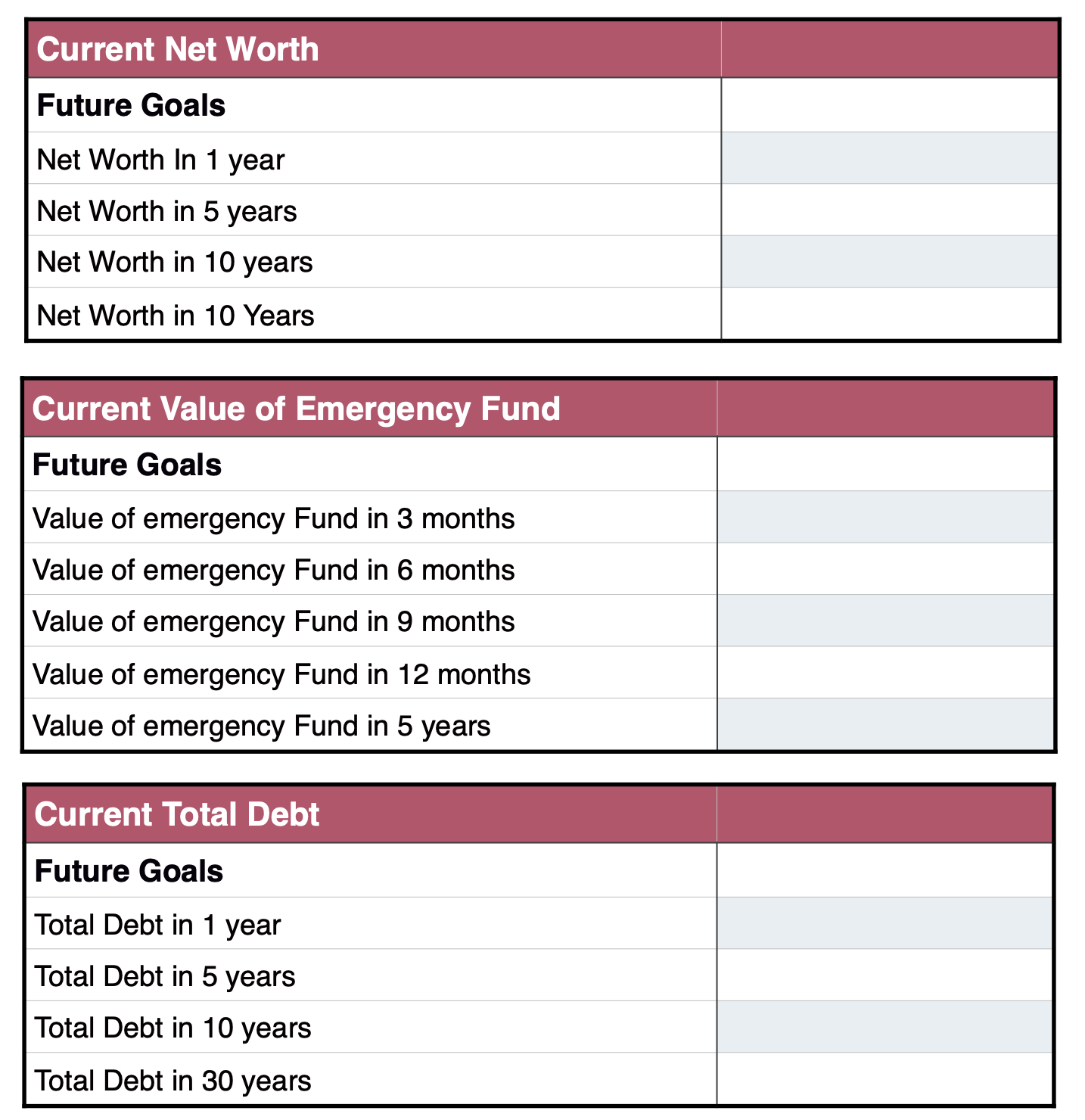

7 What to do if your goals are more ambitious than your income. This is your net worth. The analysis should be short with highlights rather than in-depth analysis.

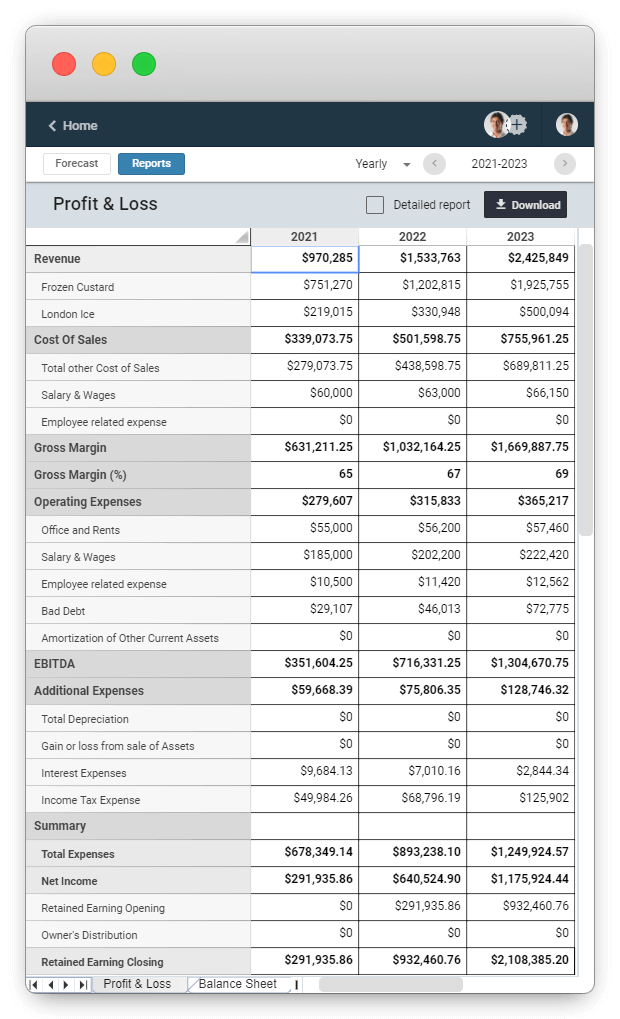

How to write the financial section of a business plan. The income statement is one of the three parts that make up the financial plan. Once you have that it will just make things a whole lot easier and more convenient in the end.

How to Write the Financial Section of a Business Plan An outline of your companys growth strategy is essential to a business plan but it just isnt complete without the numbers to back it up. Prepare your income statement. The other aspect of where you are now is your cash flow.

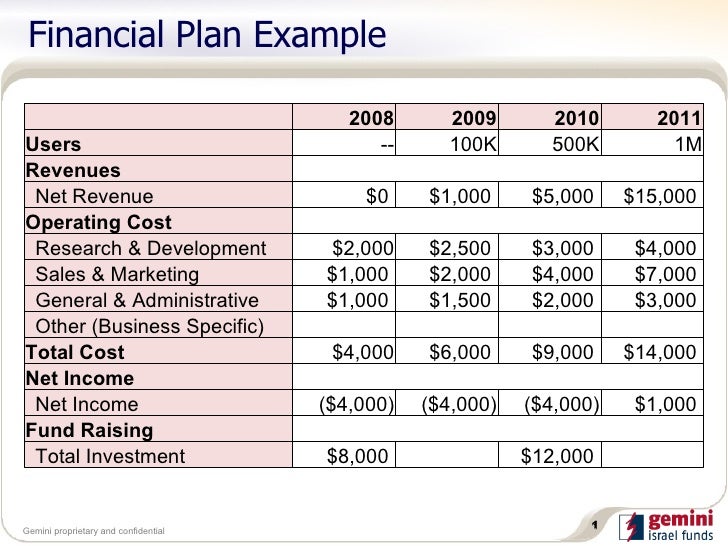

It will provide you and your investors with a financial picture of how the company is doing or will do. That is Financial Planning. Your financial plan should include a list of all of these costs.

Just like the other plans you must also prepare a detailed financial plan covering all financial aspects of your financial advisory startup. Its important that you work out as much of your financial plan as possible yourself. The financial plan for a start-up.

The financial plan should present a detailed map of the costs of startup inventory payroll equipment rent utilities and how these costs will be covered by the earned profits. If youre writing a business plan for an established company use past financial records as a starting point. Develop your financial goals 3.

3 Review all your debt and your plan for paying it off. These will help you create a solid basis for your figures. It is essential to identify and include the probable expenditure and earnings to be a financial plan.

One of the key elements of financial planning is learning how to write a financial plan for a start-up business. Determine your current financial situation 2. 5 List your short and long-term financial goals.

Increasing net worth is a sign of improving financial health. Working together I review your goals write a multi-page plan and monitor the results making changes when needed. Its the right thing to do and the right way to do it.

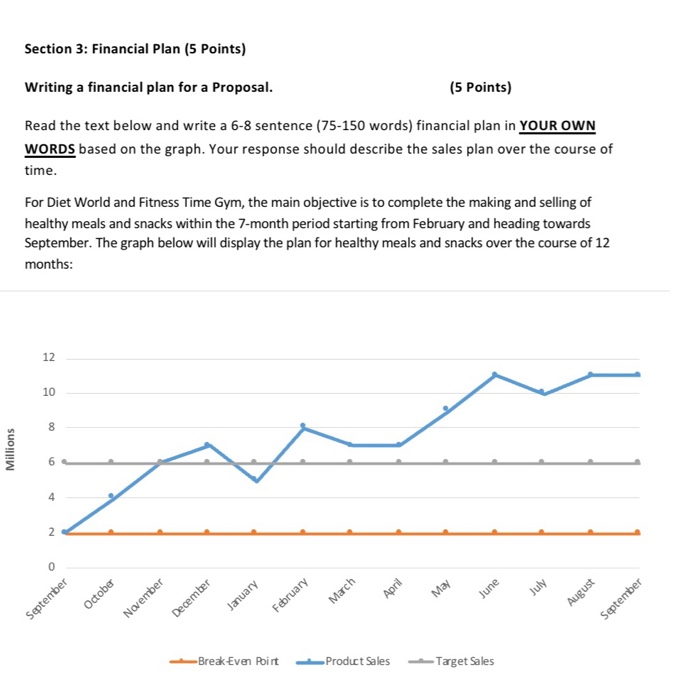

Click HERE for a detailed Sample Financial Plan. When you create the plan youll need to think about a broad range of issues including your businesss grossoperating margins profit potential fixedvariable costs break-even point potential changes to cash flow and profit durability. Dont be intimidated by the complexity of your plan.

Identify alternative courses of action 4. Base it on your business plan and keep it simple. The annual financial plan is appropriate for merchandise business.

This is your liability total. Targeted market research and a sound marketing plan should be part of your business plan. It depends on the type of business operations.

That means the financial plan needs to be solid and to show the right amount of value that people can get in the long run. Click HERE for the shorter Executive Summary. One can make plan monthly quarterly semi-annually annually or for several years.

When youre just starting out your expenses are high. Personal financial plan has six basic steps. Download the Sample Balance Sheet Template.

Add up all these numbers. The financial statements themselves should be placed in your business plans appendices. Creating a financial plan doesnt have to be complicated.

The income statement is a financial statement that will express your companys revenue and expenses. Review and revise the financial plan It is never too early to begin planning.