Federal Tax Payment Plan

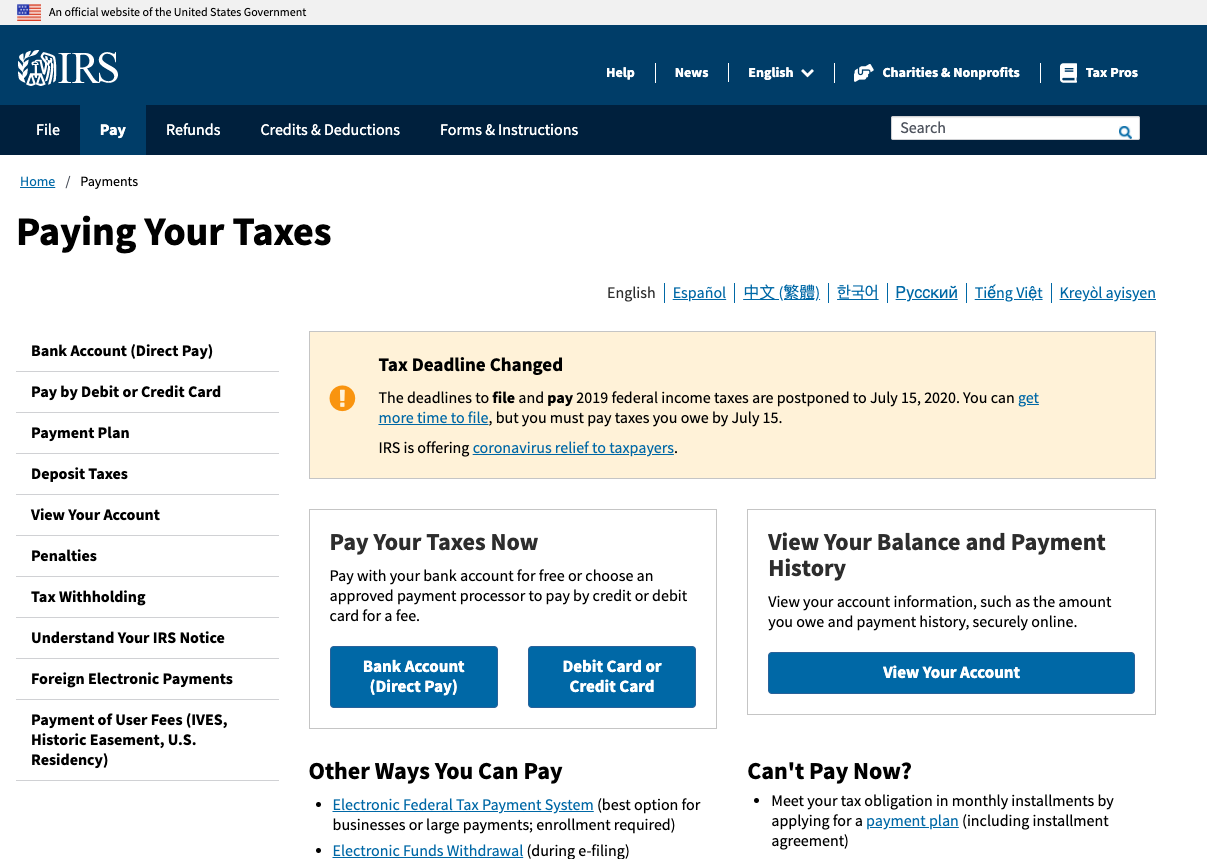

Pay amount owed in full today electronically online or by phone using Electronic Federal Tax Payment System or by check money order or debitcredit card.

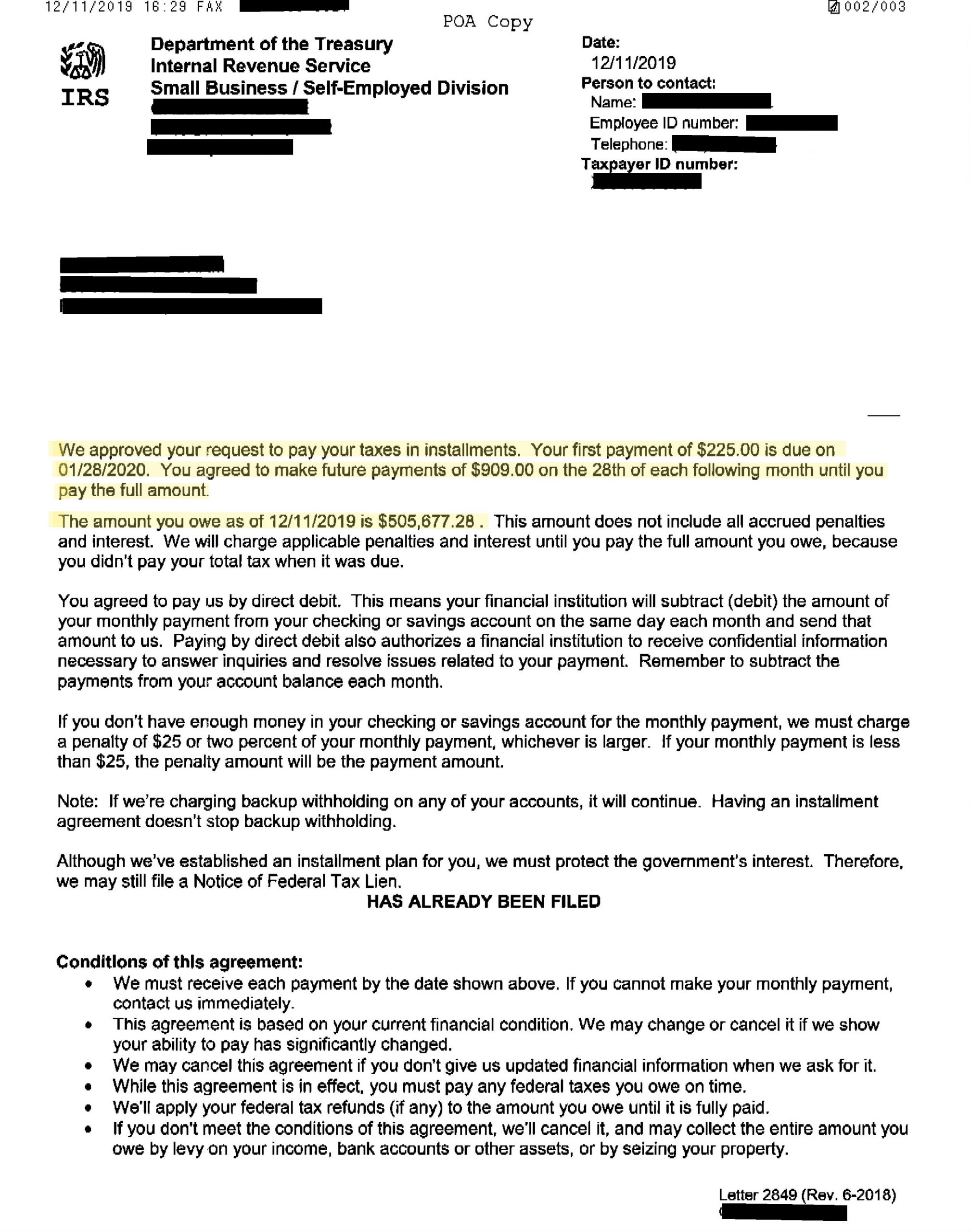

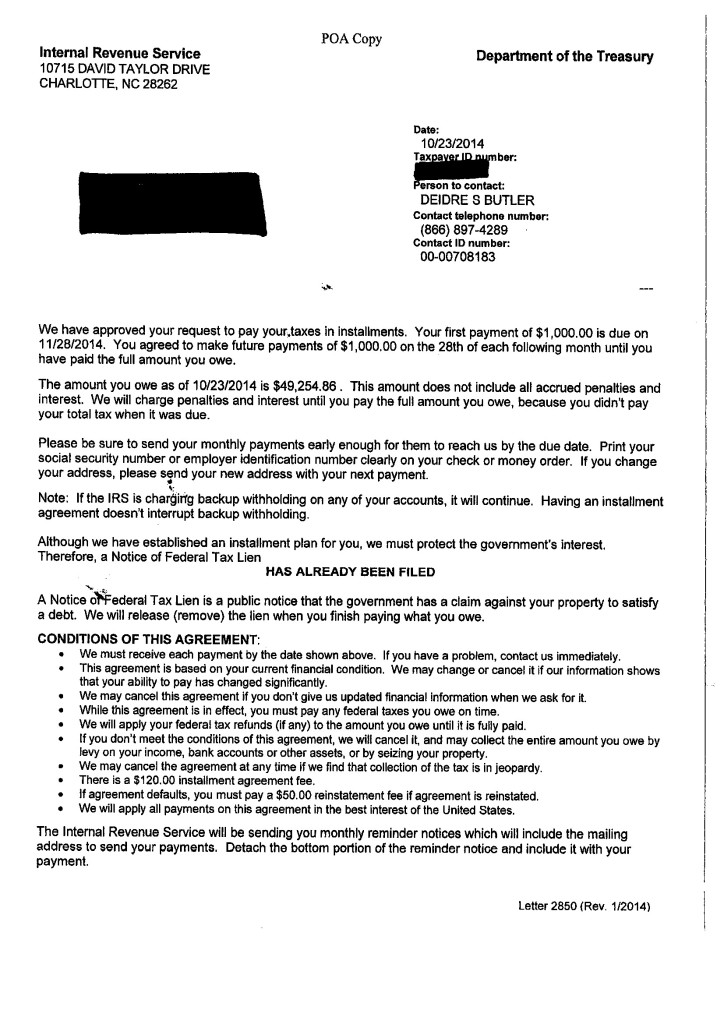

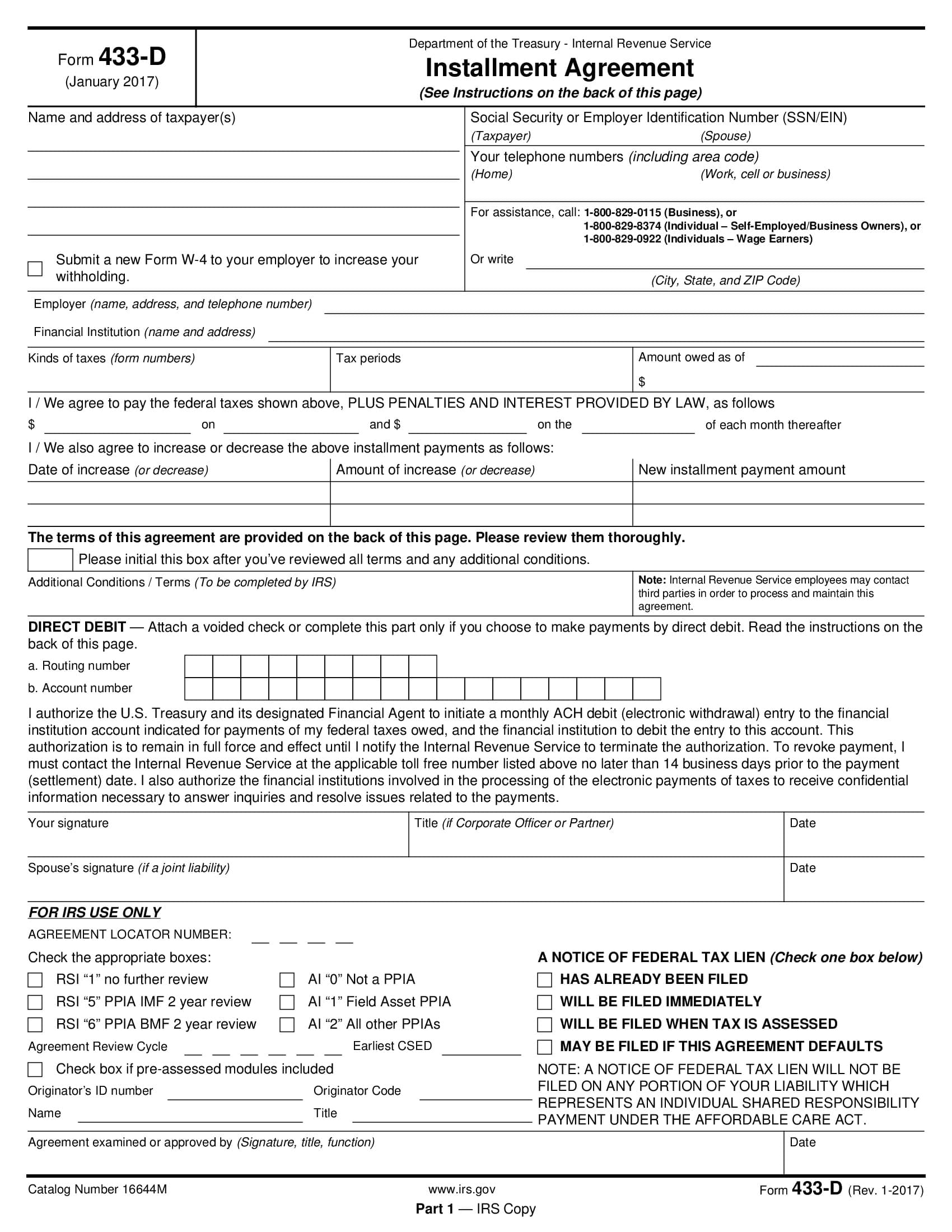

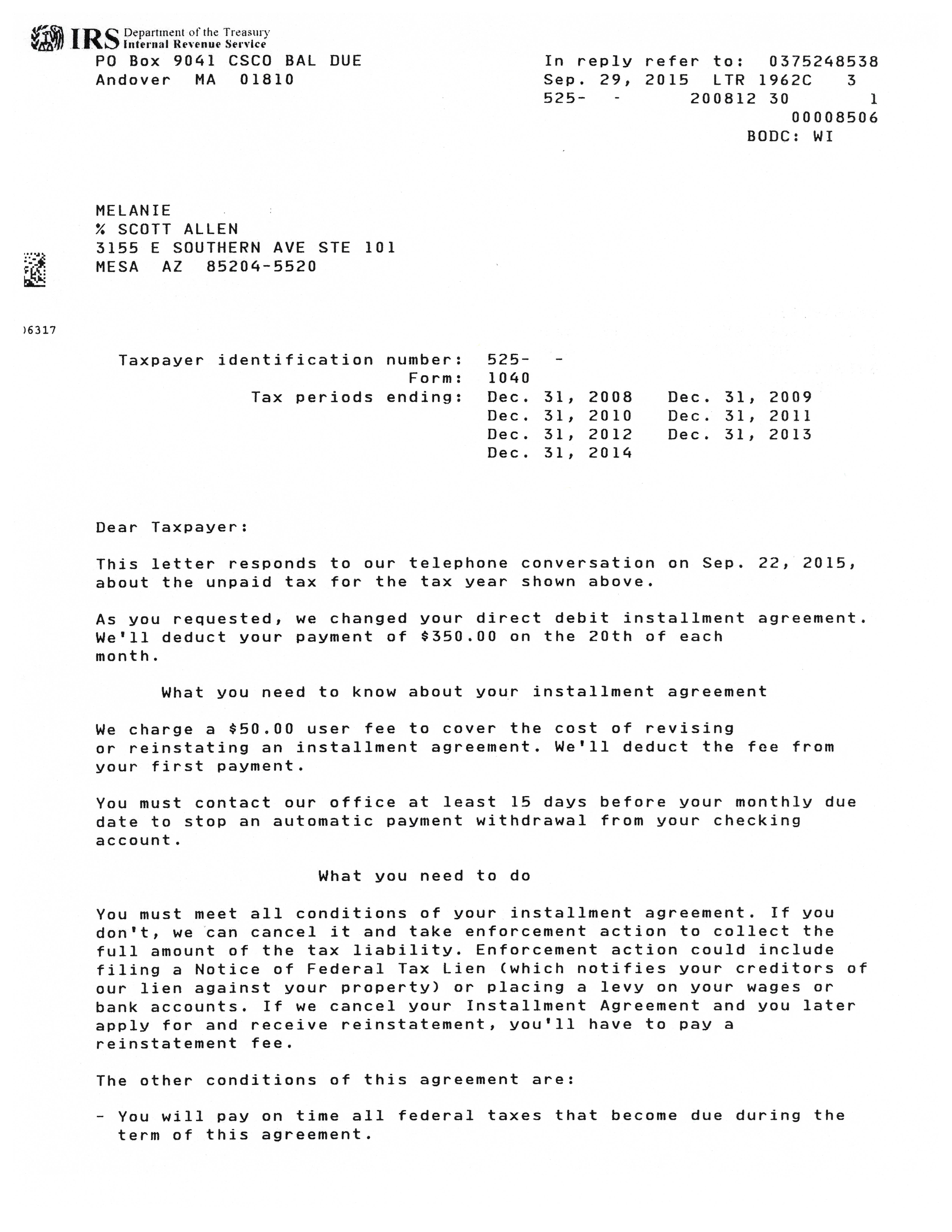

Federal tax payment plan. Fees apply when paying by card. Enrollment required Electronic Funds Withdrawal during e-filing Same-day wire bank fees may apply Check or money order. When you fall behind on your income tax payments the IRS may let you set up a payment plan called an installment agreement to get you back on track.

In order to do so the IRS will typically verify whether current tax payments have been made depending on the type of installment agreement you qualify for. Electronic Federal Tax Payment System best option for businesses or large payments. The IRS debitcredit card program cannot accept IRC 965 payments for tax years 2017 2018.

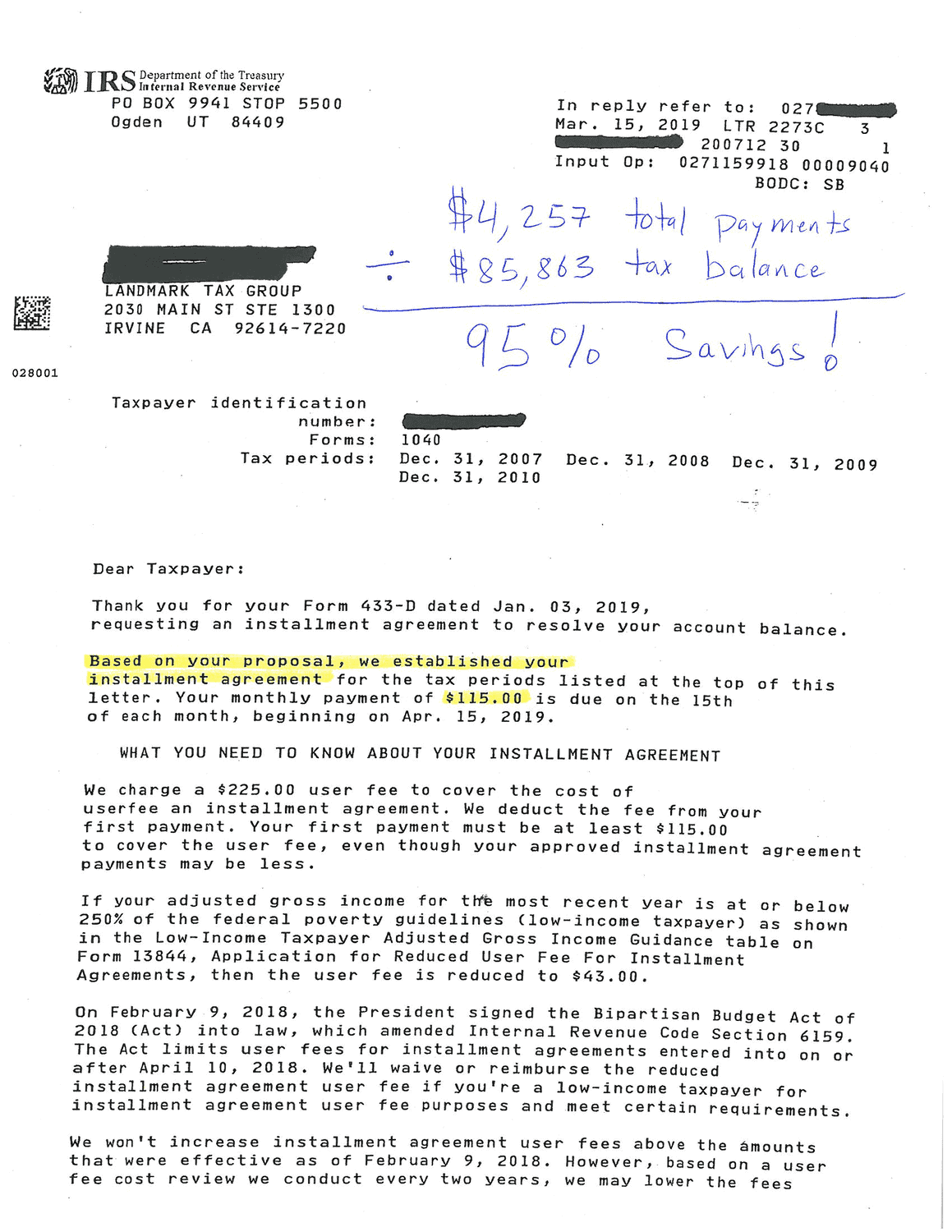

If this has happened to you you may have used a convenient options known as the Federal Tax Installment Plan sometimes called a tax payment plan or a tax repayment agreement No matter what its called its a convenient way to pay your taxes in steady regular installments instead of a lump sum which many people cant afford. The only way to avoid accruing interest on your tax balance is to pay in full by April 15 for the previous tax year. The Maryland Comptrollers office is likely to grant you a 24-month window for a Maryland tax payment plan.

Make and View Payments. The IRS tax payment plan interest rate is currently 6 percent and is updated each quarter. IRC 965 is a transition tax on the untaxed foreign earnings of certain specified foreign corporations as if those earnings had been repatriated to the United States.

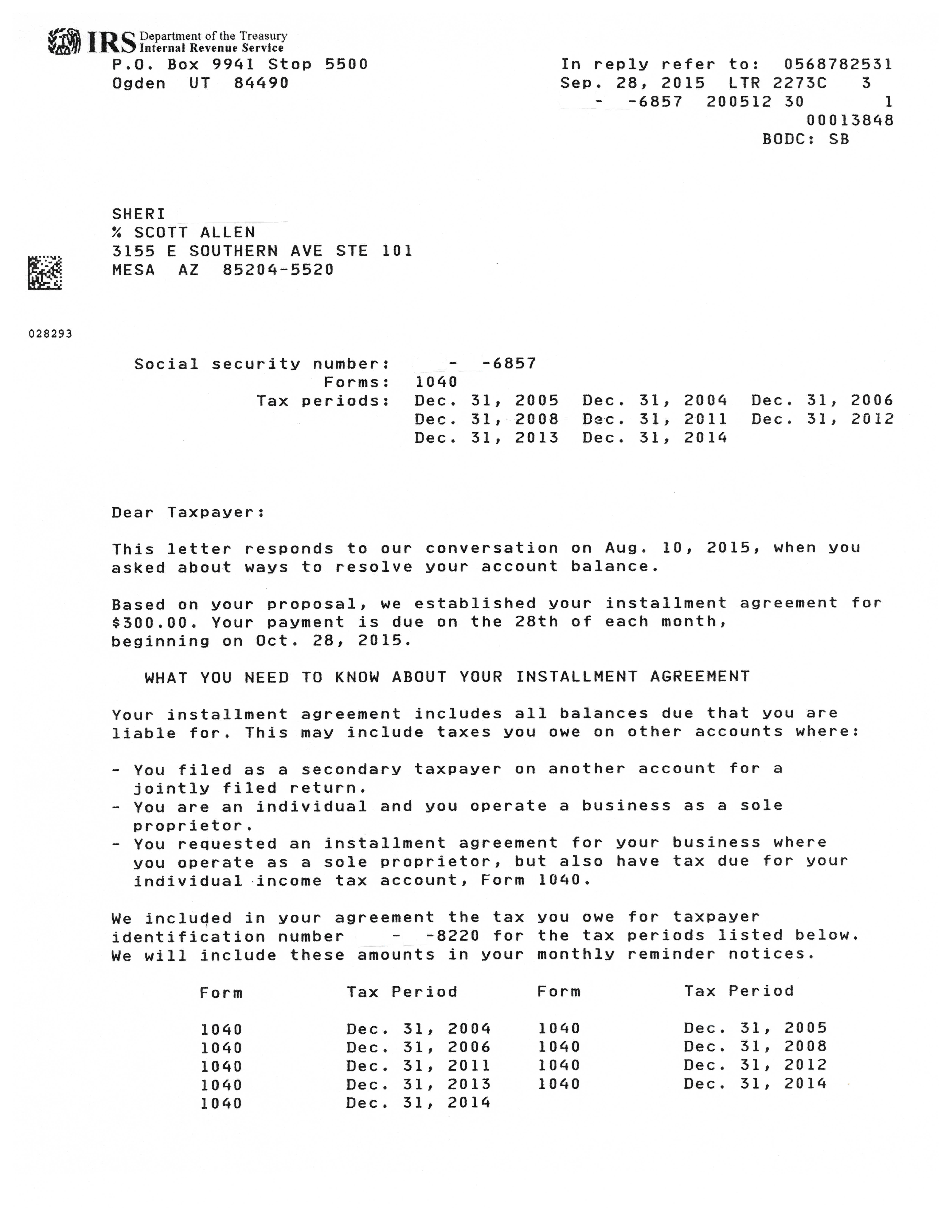

If you need more time youll need to complete Form MD 433-A. You can set up a short-term or long-term plan depending on whether you can afford to pay the IRS within 180 days. If you dont qualify for the IRSs Offer In Compromise program a Payment Plan may be the way to resolve your problem.

For business tax types the fee is a deductible business expense. The IRS offers both short-term and long-term payment plans. Long-Term Payment Plan Installment Agreement pay monthly Pay monthly through automatic withdrawals.

Learn about payment plan options and apply for a new payment plan. In addition youll have the opportunity to set up recurring payments to. Make a payment from your bank account or by debitcredit card.

View the amount you owe and a breakdown by tax year. There are two kinds of IRS payment plans. Long-term payment plans will vary based on the amount of taxes you owe.

Please contact the IRS for other payment options. If you need more than 120 days to pay your tax bill consider applying for an IRS installment payment plan also known as a long-term payment plan. Taxpayers who owe less than 10000 typically have up to three years to pay.

Before the IRS will accept a payment plan they will want to ensure another tax liability is not going to occur next year. You may be asked to submit a down payment when setting up your Maryland tax payment agreement. An IRS payment plan is an agreement to pay a federal tax debt within a specific timeframe.

View or Create Payment Plans. An IRS payment plan is an agreement you make directly with the agency to pay your federal tax bill over a certain amount of time. Your card statement will list this payment as United States Treasury Tax Payment The convenience fee paid to your provider will be listed as Tax Payment Convenience Fee or something similar.

View details of your payment plan if you have one. Interest will continue to accrue if you set up an. This is an agreed settlement between the taxpayer and the IRS based on the National standards to determine what amount the taxpayer will be paying the IRS each month but allowing the taxpayer to afford food housing clothing medical and transportation.

View 5 years of payment history and any pending or scheduled. Short-term IRS payment plans must be paid within 120 days or less this is now extended to 180 days under the Taxpayer Relief Initiative. Taxpayers who cannot afford to pay their Federal payment plan balance must explore other settlement options to avoid collection actions.

Depending on how much you owe you can opt into a short-term or long-term payment plan for owed taxes. Even if the IRS does not verify current taxes taxpayers should. Key Takeaways An IRS payment plan lets you spread out your tax bill over a period of time if you cant afford to pay your tax debt.

A federal tax payment plan lets you repay tax debt over time in monthly installments. This form of payment eliminates your need for a voucher. Other Ways You Can Pay.

Its convenient to apply and pay online but you can also call the IRS or the number listed on your tax bill to apply or apply by mail or in-person.

/9465-700bb91065234917b8d2866f2306afe9.jpg)

/GettyImages-505872588-5bca34b346e0fb0051748309.jpg)