Donald Trump Tax Plan 2016

The Tax Foundation estimated that even if he increased GDP by 11 percent his tax plan would cause revenues to decrease by 104 trillion thats more than the budget deficit alone.

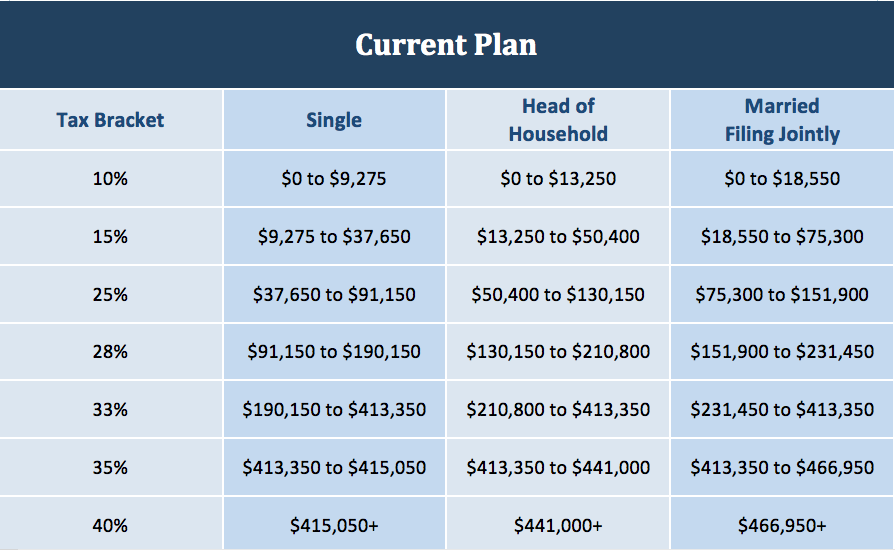

Donald trump tax plan 2016. The Trump Plan will increase the standard deduction for joint filers to 30000 from 12600 and the standard deduction for single filers will be 15000. Reduce the top tax rate on pass-through business income from 396 to 15 percent. 4 rows Introduction.

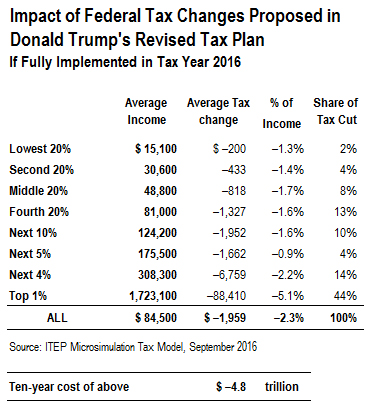

2016 Key Findings Republican presidential candidate Donald Trumps tax plan would significantly reduce income taxes and corporate taxes and eliminate the estate tax. Trump Tax Reform That Will Make America Great Again accessed July 21 2016 Tax Policy Center An Analysis of Donald Trumps Tax Plan Dec. Trump said his plan would lower businesses tax rate to 15 percent and would incentivize American corporations who have stashed cash overseas to repatriate it to the United States.

42 million households that currently file complex forms to. Reduce the federal tax brackets from 7 to 3 with rates of 12 25 and 33. An Analysis of Donald Trumps Revised Tax Plan.

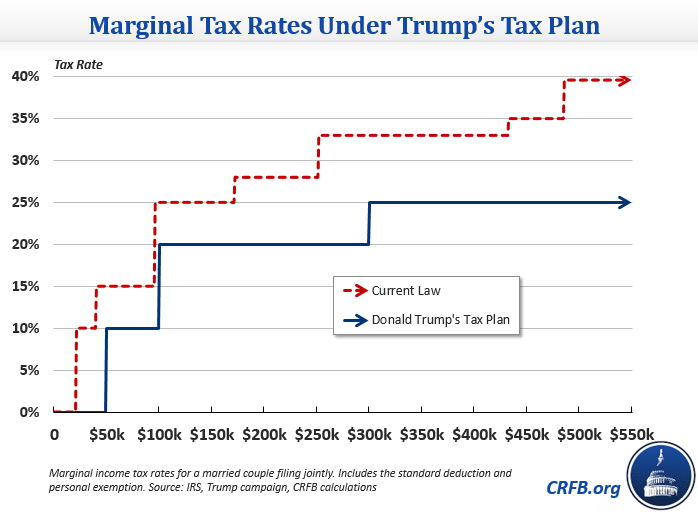

The personal exemptions will be eliminated as will the head-of-household filing status. Trumps plan would reduce the current seven tax brackets to four with a 0 percent rate applying to all those making less than 25000 50000 for married couples. Reduce the top personal income tax rate from 396 percent to 25 percent and reduce the number of tax brackets from 7 to 3.

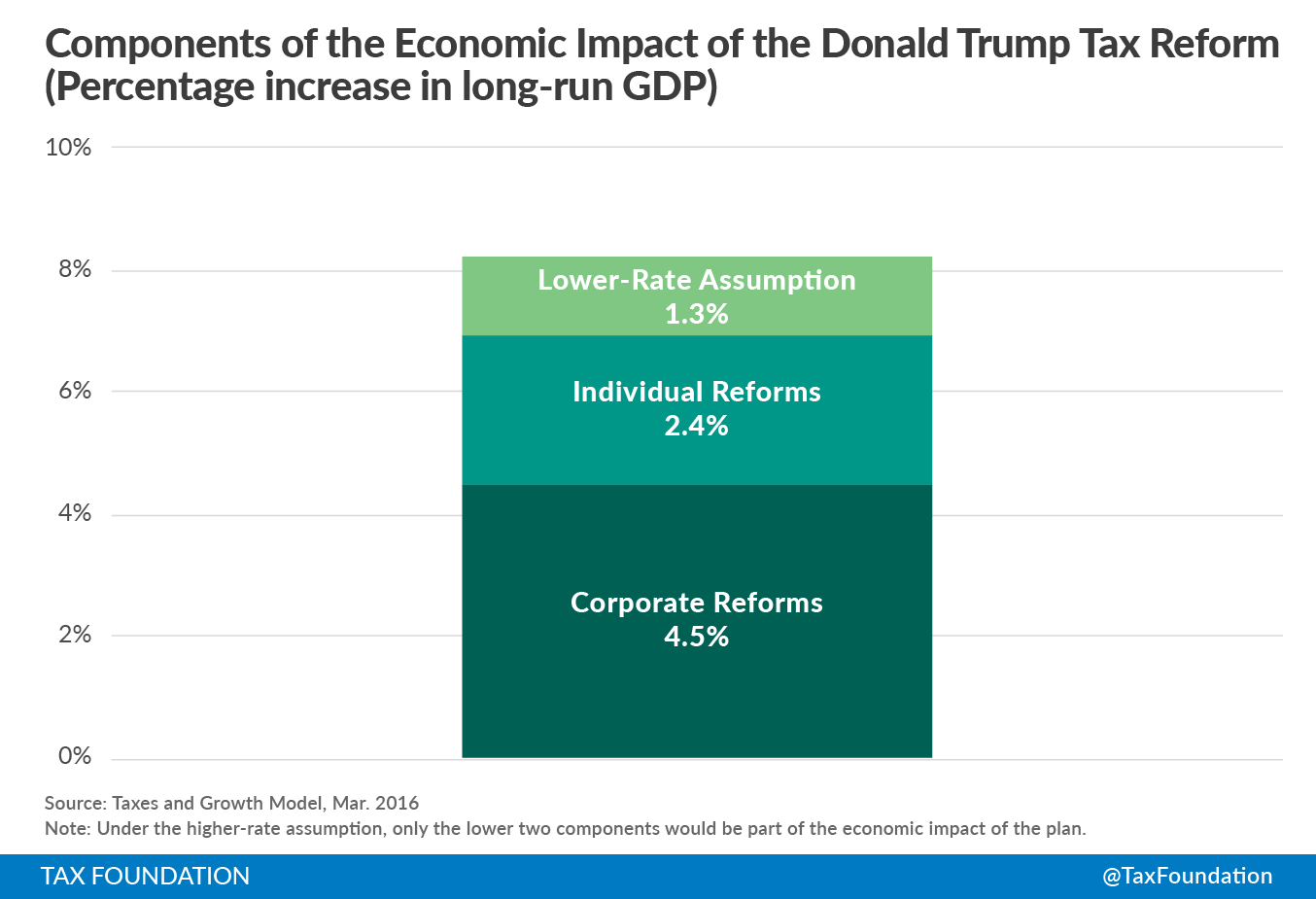

Trumps revised campaign plan released in 2016 would have scrapped the head of household filing status potentially raising taxes on millions of single-parent households according to an. Trump announced a revised tax plan on August 8 2016. According to the Tax Foundations Taxes and Growth Model the plan would.

His immediate two predecessors Barack Obama and George W. Today in New York presidential candidate Donald J. Donald Trumps Tax Plan is to cut corporate tax rate from 35 to 15.

The plans tax cuts include. This a huge tax cut and could cause the US to see a a lot of job creation. The revised plan sets the top individual income tax rate at 33 percent.

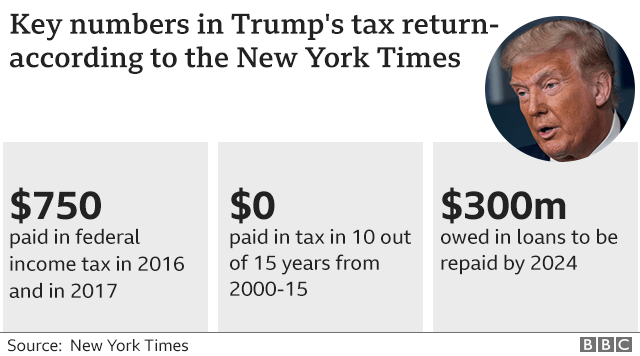

A Simpler Tax Code For All Americans When the income tax was first introduced just one percent of Americans had to pay it. Effective marginal individual income tax rate and individual income plus payroll tax rate on wages and salaries under current law and Donald Trumps revised tax. Bush routinely paid 100000 annually in federal income tax and sometimes far more.

Reduce taxes for highest income earners by 102. This was much less than other recent presidents paid while in office. Reduce taxes for low income earners by an average of 12.

Donald Trumps economic plan proposes tax cuts reduced regulation lower energy costs and eliminating Americas chronic trade deficit. Since his tax plan wont generate additional revenue by itself much of Trumps plan to reduce the budget deficit revolves around boosting business productivity. The Trump plan eliminates the income tax for over 73 million households.

Reduce the federal corporate income tax rate from 35 to 15 percent. Trump would repeal the special 4 add-on tax substitute for Medicare taxes. His first tax plan announced on September 28 2015 would have reduced the highest individual income tax rate from 396 percent to 25 percent.

It was never intended as a tax most Americans would pay. Burman Jeffrey Rohaly Joseph Rosenberg. Trumps goal is to significantly increase Americas real GDP growth rate and thereby create millions of additional new jobs and trillions of dollars of additional income and tax revenues.

Trump would tax investment fund managers on profits interests as regular earners. In 2016 Trump paid only 750 in federal income tax and in 2017 he paid another 750 in federal income tax. It does also help the 1 keep a lot of the money in their pockets.

Trump released a tax reform. Donald Trump Tax Reform Plan September 2016 By Alan Cole Economist No. T16-0216 - Effective Marginal Tax Rates EMTR On Wages and Salaries Under Current Law and Donald Trumps Revised Tax Plan By Expanded Cash Income Level 2017.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/5848035/trump_breakdown.jpg)