Defined Benefit Plan Limits

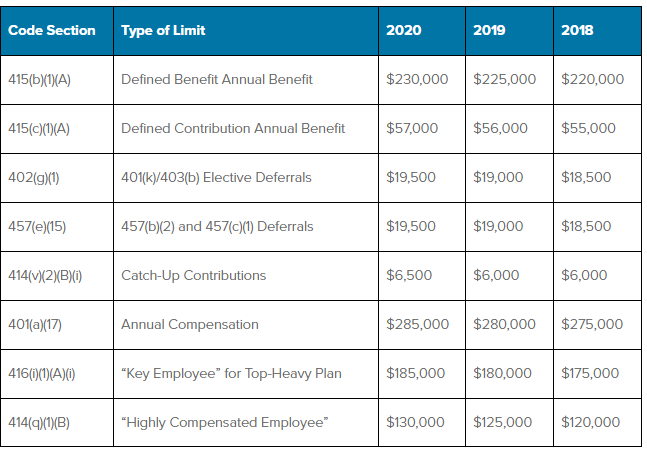

The Annual Benefit Limit is the maximum annual benefit that can be paid to a participant IRC section 415.

Defined benefit plan limits. Employee compensation limit for calculating contributions. How Much Can Be Paid Out. Limitation under a defined benefit plan under 415b1B is computed by multiplying the participants compensation limitation as adjusted through 2020 by 10122.

10 rows Defined contribution maximum limit employee employer age 49 or younger 3. Although employees generally have little control over their benefits there are still annual limits for defined benefit plans. 100 of the employees compensation averaged for the highest 3 consecutive years.

The lifetime limit for a Defined Benefit Plan is a function of age at payout. 100 of the participants average compensation for his or her highest 3 consecutive calendar years or 230000 for 2021 and 2020 225000 for 2019. Employee stock ownership plan ESOP limit for determining the lengthening of the general five-year distribution period.

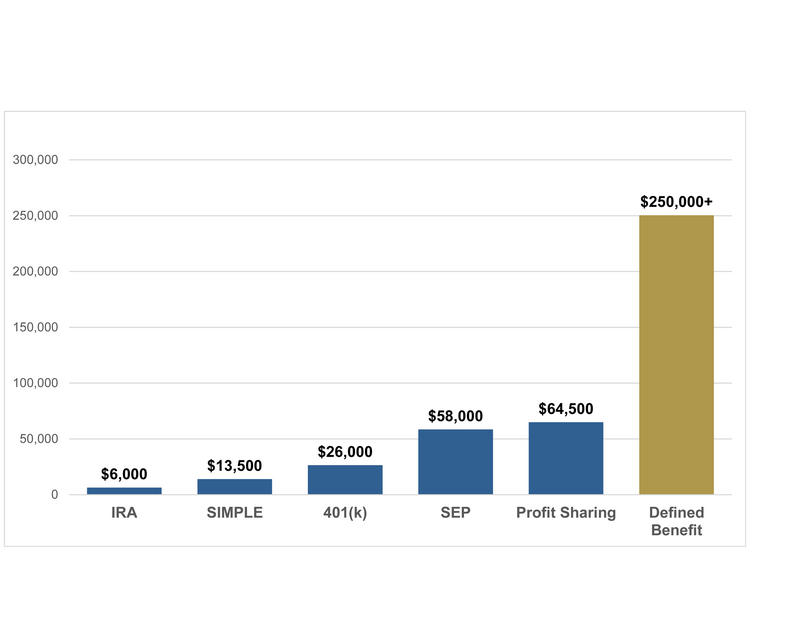

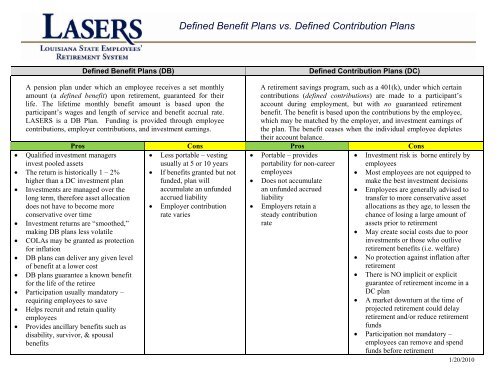

The Elective Deferral Limit is the maximum contribution that can be made on a pre-tax basis to a 401 k or 403 b plan Internal Revenue Code section 402 g 1. 1 2022 the annual benefit limit for defined benefit plans is computed by multiplying the participants compensation limit as adjusted through 2021 by 10534. A defined contribution DC plan is a type of retirement plan in which the employer employee or both make contributions on a regular basis.

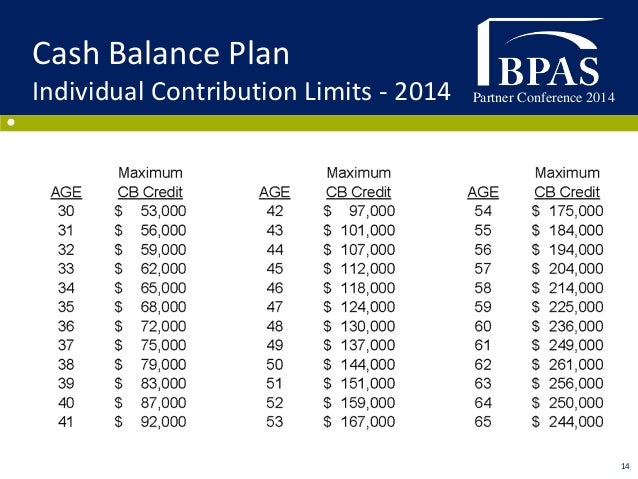

Defined Benefit Lifetime Limit Prorated for Service. Defined contribution maximum limit if age 50 or older by year end. What is the IRS annual compensation limit for a Defined Benefit Plan.

The 2021 IRS annual compensation maximum limit used to calculate the defined benefit contribution is 230000 and in 2020 the IRS compensation maximum limit is 230000. Defined contribution plan annual contribution limit. For a participant who separated from service before Jan.

There are no fixed deductible contribution limits to defined benefit pension plans. Or 225000 as discussed. Sole proprietorships S and C corporations LLCs and partnerships are eligible.

Defined Benefit Plan Contribution Limits. Planned retirement age - In general planned retirement age is at least 5 years from the year the plan is adopted. The limits get trickier when there is a combination of defined benefit and defined contribution plans.

What type of businesses are eligible for a Defined Benefit Plan. The lifetime limit phases in over a 10-year period. In 2021 the IRS annual compensation maximum limit used to calculate the defined benefit contribution is 230000.

Maximum contribution all sources plus catch-up. The annual defined benefit limits may not exceed the lesser of. Lifetime Limit Adjusted for.

Lifetime Limit Depends on Payout Age. In 2022 the annual benefit. The limitation for defined contribution plans under 415c1A is increased for 2021 from 57000 to 58000.

The maximum annual benefit that may be provided through a defined benefit plan is increased to 245000 from 230000. Some still refer to this as the 7000 limit its original setting in 1987. Thus if the limitation under section 401 a 17 for years beginning in 2008 2009 and 2010 is 230000 235000 and 240000 respectively then the limitation under section 415 b 1 B based on Ns average compensation for the period of Ns high three years of service is 235000.

Defined benefit plan annual benefit and accrual limit.