Charitable Donations New Tax Plan

Currently taxpayers may deduct charitable gifts of up to 100 of adjusted gross income for cash contributions.

Charitable donations new tax plan. How Bidens Tax Agenda Could Impact Charitable Donations With the Democrats controlling the House Senate and presidency theres the real possibility that donors will have a lot less disposable. There are a number of tax-related items you should keep in mind regarding charitable donations. Donating Stocks There are multiple avenues an individual can use for charitable donations that can maximize the tax benefit.

The most important thing is. Under the current rules the donor would be allowed a charitable deduction of 200000 on the donors 2021 tax return the year in which the property was contributed based on the fair market. January 2018 ushered in the most comprehensive tax law change in more than 30 years and this law has important implications if you plan to make charitable contributions this year or in the future.

The new law actually increases the allowable deduction for cash donations made to public charities from 50 percent of Adjusted Gross Income AGI to 60 percent of AGI. This section offers tax deductions on donations made to certain funds or charities. A searchable database of organizations eligible to receive tax-deductible charitable contributions.

While this aims to simplify the filing process for most Americans it could complicate giving strategies for many who regularly deduct their charitable contributions each year. Check the deduction amount calculation with example list of funds eligibility documents payment mode for the FY 2019-20 AY 2020-21 FY 2020-21 AY 2021-22. December 27 2017.

Amount and types of deductible contributions what records to keep and how to report contributions. Complicating this is the fact that during his 2020 presidential campaign President Biden expressed support for limiting charitable deductions such that taxpayers making more than 400000 per year could only. Adding together expenses you paid such as mortgage interest state and local taxes medical and dental expenses charitable gifts and donations etc.

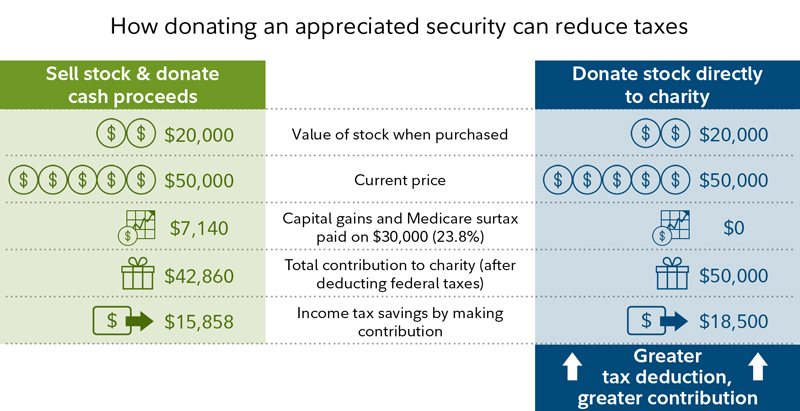

Section 80G Deduction for Donations to certain Charitable Institutions Funds etc. The illustration below demonstrates how charitable giving becomes more tax-efficient or cheaper for wealthy donors after an income tax increase. This is either greater than or less than 13000 for married couples and 6500 for single people.

The tax rules governing charitable contributions remained largely intact under the Tax Cuts and Jobs Act which was recently signed into law by President Trump. WASHINGTON The Internal Revenue Service today reminded taxpayers of a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year. An amount donated by an individual to an eligible charity can be claimed as a tax deduction while filing of an income tax.

Heres how to plan your giving to hold on to that popular tax break. How donors charities and tax professionals must report non-cash charitable contributions. But financial experts say donating cash may not offer the highest tax benefit.

Under President Joe Bidens proposed tax plan taxpayers making more than 400000 per year would be taxed at a top income tax rate of 396 an increase from 37 under current law. Under the Tax Cuts and Jobs Act it is harder to claim the tax deduction for charitable contributions. The first tax reform proposal offered by Trump last year preserved the current charitable deduction.

Itemized deduction amount. The IRS requires proper documentation for charitable deductions. Fidelity Charitable for instance received more than 4 billion in donations in 2016 topping United Way Worldwide which Forbes has ranked as the largest nonprofit organization by private donations.

Following special tax law changes made earlier this year cash donations of up to 300 made before December 31 2020 are now deductible when people. This latest version proposes to cap all itemized deductions including the charitable deduction mortgage interest deduction and state and local taxes paid to 100000 for single filers and 200000 for couples.

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)