457 Plan Withdrawal For Home Purchase

Please contact us if you think we are infringing copyright of.

457 plan withdrawal for home purchase. Money saved in a 457 plan is designed for retirement but unlike 401 k and 403 b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half years old. It is true that borrowing from a 457b plan may be used for first-time home buying. However it must be a loan from the plan not a withdrawal.

If approved you can receive up to the full amount of your 457 account balance. Please contact us if you think we are infringing copyright of. Withdrawals from 457b plans.

Unlike 403 b and 401 k accounts participants can take regular withdrawals from 457 plans as soon. 457 Plan withdrawal for Home Purchase Onyx Homes Floor Plans House Design Plans is related to House Plans. If you looking for 457 Plan withdrawal for Home Purchase Acarf Allen County Animal Rescue Facility Animal Shelter and you feel this is useful you must share this image to your friends.

Withdrawals from 457 plans are indeed taxable but early withdrawals are not penalized. If you looking for 457 Plan withdrawal for Home Purchase Onyx Homes Floor Plans House Design Plans and you feel this is useful you must share this image to your friends. It is true that borrowing from a 457b plan may be used for first-time home buying.

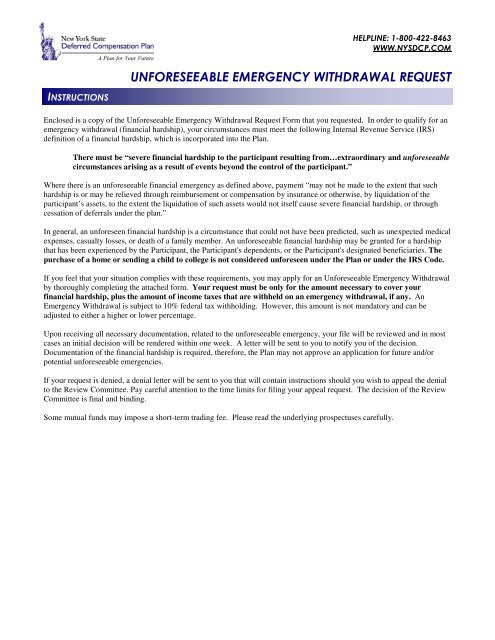

See Unforeseeable Emergency Whitepaper for additional details specific to Unforeseeable Emergency withdrawals and processing. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. So if you need to tap into your 457b contributions before you reach age 595 and youve left the job that provided you with the 457b dont fret.

401k for a home purchase while you are working and under age 59 12 is through a hardship withdrawal. The only way to withdraw money from your employer-sponsored retirement plan eg. For example if you take a 15000 distribution youll owe income tax on the distribution but you.

Know more about it here. We also hope this image of 457 Plan withdrawal for Home Purchase. We also hope this image of 457 Plan.

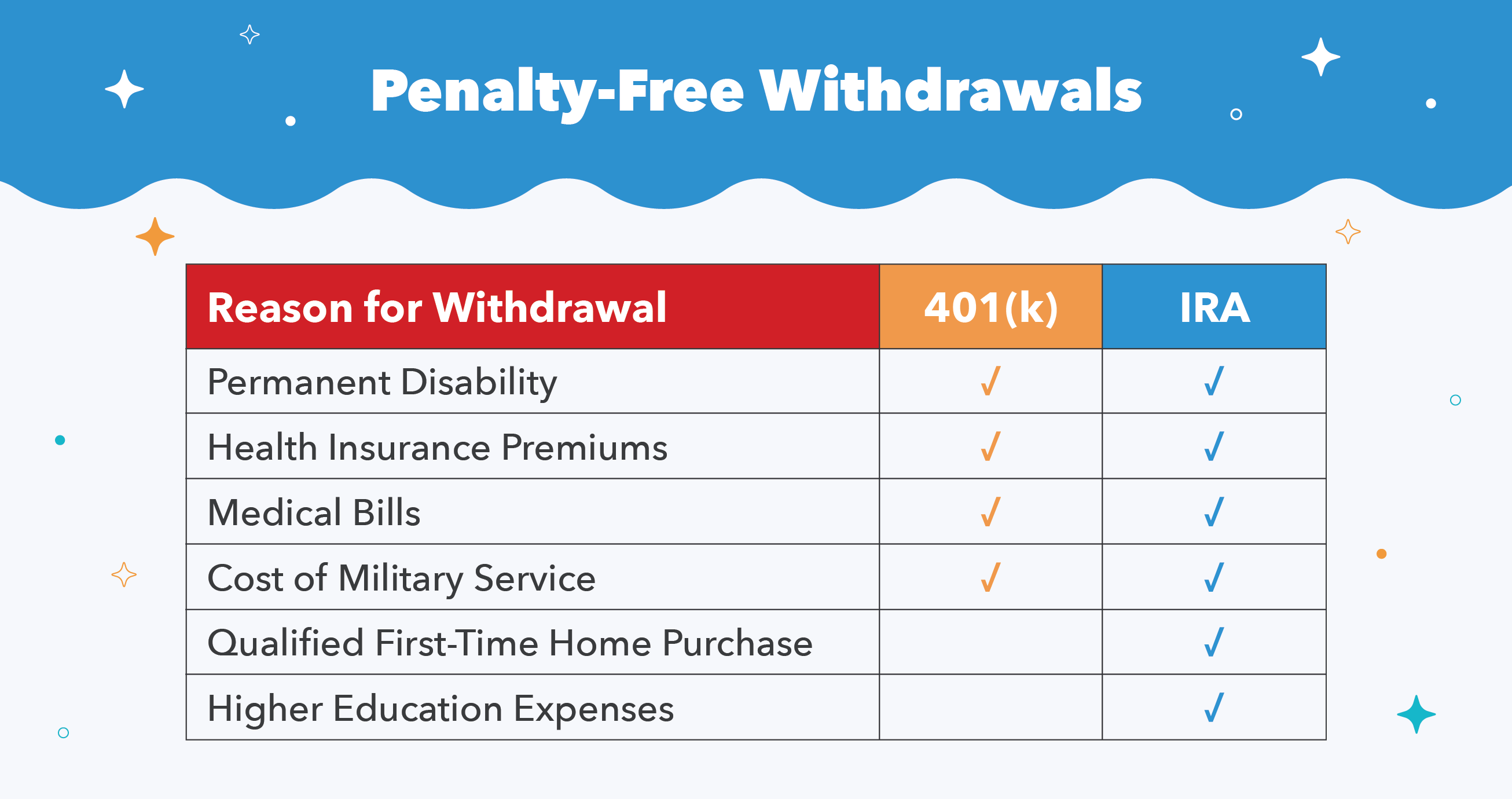

Unlike other tax-deferred retirement plans such as IRAs or 401ks you wont face a 10 percent early distribution penalty even if youre under age 59 ½. Buying a home. You can take money out of your 457 plan without penalty at any age although you will have to pay income taxes on any money you withdraw.

Decide the amount you wish to withdraw from your traditional IRA and fill out the necessary paperwork with your financial institution. There is no tax penalty for this early withdrawal and the entire withdrawal is taxed as ordinary. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are.

This is a very important rule that often times goes overlooked with the 457 plan. You may withdraw up to 10000 from your traditional IRA for the first-time purchase of a home. Besides can I withdraw from my 457 B to buy a house.

Early Withdrawals from a 457 Plan. We get our pictures from another websites search engines and other sources to use as an inspiration for you. Even then there are certain restrictions that apply which may cause some or all of the loan to be treated as a distribution subject to the 10 percent penalty.

It is true that borrowing from a 457b plan may be used for first-time home buying. Even then there are certain restrictions that apply which may cause some or all of the loan to be treated as a distribution subject to the 10 percent penalty. However you will have to pay income taxes on the distributions.

457 Plan withdrawal for Home Purchase Ira withdrawal for Home Purchase Autos Post and all other pictures designs or photos on our website are copyright of their respective owners. In the 401k plan if you needed money to buy a house or to pay tuition for a dependent you could do that. For 457 plans Unforeseeable Emergency is treated similarly to a hardship in 401k plans but there are specific differences in Unforeseeable distributions.

In addition these distributions face the IRS 10 early withdrawal penalty. However it must be a loan from the plan not a withdrawal. Todays mortgage rates.

Even then there are. Approval for an unforeseeable emergency withdrawal is not automatic. However it must be a loan from the plan not a withdrawal.

We get our pictures from another websites search engines and other sources to use as an inspiration for you.

/GettyImages_95467161-56a646e53df78cf7728c3470.jpg)

:strip_icc()/exceptions-ira-early-withdrawal-penalty-2388980-bdcaf06df21c4225bd4c9216eebbed69.jpg)